Bridging the Fair Value Gap: A Closer Look at Valuation in Modern Finance

In the world of finance, the concept of fair value is a crucial determinant of asset prices and investment decisions. Fair value is the estimated price at which an asset or liability should exchange in a transaction between willing and informed parties. However, the determination of fair value is not always straightforward and can be subject to various challenges and gaps in understanding. This article explores the notion of the "Fair Value Gap" and delves into its implications for investors, accountants, and regulators.

Understanding Fair Value

Fair value accounting plays a central role in financial markets, as it influences the allocation of resources, capital allocation decisions, and risk management. Fair value measurements are utilized for a wide range of assets and liabilities, including financial instruments, real estate, and intangible assets. It is commonly employed in various financial reporting standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP).

Challenges in Fair Value Measurement

1. Lack of Market Data: One of the most significant challenges in determining fair value is the absence of active markets for some assets or liabilities. In such cases, valuation techniques like discounted cash flow analysis or market comparables are employed, introducing a degree of subjectivity into the valuation process.

2. Illiquid and Complex Assets: Certain assets, like derivatives, structured products, and private equity investments, can be highly illiquid and complex to value accurately. The absence of observable market prices can lead to significant differences in fair value estimates.

3. Market Volatility: Asset prices can exhibit extreme fluctuations, making it challenging to determine their fair value accurately, especially during times of market turmoil.

4. Judgement and Bias: Fair value measurements often require professional judgment and expertise. The potential for bias or errors in estimation can lead to disagreements and differences in fair value assessments.

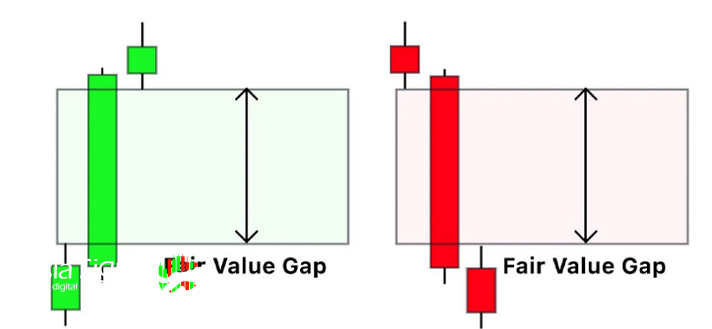

The Fair Value Gap

The Fair Value Gap refers to the disparity between the estimated fair value of an asset or liability and its market price, if one exists. This gap can result from various factors, including the challenges mentioned above. Several implications and considerations surround this gap:

1. Volatility and Risk Management: A significant fair value gap can indicate high market volatility and uncertainty, prompting investors and financial institutions to reevaluate their risk management strategies. When market prices significantly deviate from fair values, it can signal potential opportunities for profit or heightened risks.

2. Regulatory Compliance: Accounting standards, such as IFRS and GAAP, require entities to report their financial instruments at fair value. The Fair Value Gap can lead to discussions and debates about whether accounting standards adequately address the complexities of valuation, potentially necessitating revisions or clarifications.

3. Investor Confidence: Investors rely on financial statements to make informed decisions. A wide Fair Value Gap may erode investor confidence if they believe that the reported fair values do not accurately represent the true value of assets and liabilities.

4. Transparency and Disclosure: Entities that disclose a significant Fair Value Gap should provide transparent explanations of the methodologies used for valuation and the factors contributing to the gap. This transparency can enhance stakeholders' understanding and trust in the reported figures.

Bridging the Gap

Addressing the Fair Value Gap requires collaboration among various stakeholders, including accountants, regulators, investors, and financial analysts. Here are some strategies to bridge the Fair Value Gap:

1. Improved Data and Technology: Investing in advanced data analytics and technology can enhance the accuracy of fair value measurements. Utilizing real-time data and machine learning algorithms can help in providing more precise valuations.

2. Standardization and Guidance: Regulators and accounting bodies can provide clearer guidance on fair value measurement methodologies, particularly for complex and illiquid assets. Standardization can reduce subjectivity and disagreements in valuation.

3. Enhanced Disclosure: Entities should provide comprehensive disclosures about their fair value measurements, including the assumptions and inputs used. This can help stakeholders better understand the reasons behind any discrepancies between market prices and fair values.

4. Risk Management Strategies: Investors and financial institutions should develop robust risk management strategies that account for potential Fair Value Gaps. Stress testing and scenario analysis can help identify vulnerabilities in the face of market volatility.

Conclusion

The Fair Value Gap is an essential concept in modern finance, reflecting the challenges and complexities inherent in estimating the fair values of assets and liabilities. Bridging this gap requires a multifaceted approach, involving improvements in data, technology, transparency, and regulatory guidance. As financial markets evolve, addressing the Fair Value Gap will remain a crucial task to ensure the accuracy and reliability of financial reporting and investment decisions.

you can find the Best trading view indicators for the crypto in Asiasignal.

Comments