Maybe you have heard the word DeFi in the field of cryptocurrency and blockchain technology many times in the last few years and you ask yourself what is DeFi, what is its use, and how to invest and earn money through it. If you want to know more about this, stay with us for the rest of this article.

If you are familiar with the digital currency market, you must have heard the word DeFi many times. In simple terms, DeFi can be considered equivalent to a decentralized virtual bank, which is not managed by any person or institution, and its security and efficiency are provided by blockchain technology. DeFi is a revolution in financial affairs, the number of users of which is increasing day by day with the development of blockchain. In this article, we will answer the question of what is DeFi and what it is used for in simple language, and we will also discuss its advantages, features, applications, and the most famous platforms.

Many believe that DeFi will revolutionize the way we conduct financial transactions, but because it is still largely unregulated, investors typically do not have the same protections as they do in traditional financial markets. Despite the risks, the possibilities enabled by DeFi make it a very exciting space for crypto investors. Stay with us in the rest of this article which is written by Asiasignal experts, because in this article Asiasignal intends to discuss information about how it works, the application and challenges of decentralized financial technology, projects, features and advantages, disadvantages, and the future of DeFi.

You can also be a VIP member of the Asiasignal VIP crypto signal Telegram channel to get the latest news and information as well as the crypto signal leaks.

What is DeFi?

The projects, platforms, and sets of services that use blockchain and remove the middleman or third party from traditional finance are called DeFi. DeFi is composed of two words Decentralized and Finance. The word finance refers to financial products; We deal with many financial products in our daily life, for example, getting a loan from the bank is a financial product. Decentralized means that no central entity (such as the government or bank) is in control. As a result, DeFi means decentralized finance or providing financial products in a decentralized manner.

DeFi is a comprehensive and complete term for an important part of the world of cryptocurrency. DeFi projects seek to create the necessary infrastructure for a new and indigenous blockchain-based financial system. This financial system is defined as an alternative to the traditional intermediaries common in today's business transactions.

Bitcoin is a decentralized currency launched on the Bitcoin blockchain network. Now, if we launch a financial product on a blockchain network, we have created a decentralized application. Decentralized finance is based on a secure distributed ledger similar to that used by cryptocurrencies. This system removes the control of banks and institutions over money, financial products, and financial services.

DeFi is available to anyone who can use Ethereum and is connected to the Internet. With DeFi, markets are always open and there is no centralized authority that can block payments or prevent you from accessing anything. Services that were previously slow and vulnerable to human error are now automated and more secure because they are controlled by code that anyone can inspect and verify.

DeFi projects, with the help of blockchain technology infrastructure and digital currencies, set the conditions in such a way that the transaction parties do not need the presence of an intermediary. DeFi projects can provide their users with the key services of banks, exchanges, etc., including lending, borrowing, and trading.

The presence of intermediaries may lead to the establishment of trust in financial transactions, but we should not forget that it limits users' access to capital and financial services. Also, the side costs of users accessing financial services in the presence of intermediaries increase; Because these centralized institutions receive relatively high fees for providing services.

Banks and centralized associations have long dominated the fiscal world. Today, if you want to get a loan, buy and sell, or pay your installments and taxes, you have to go to the bank, the government, or other centralized organizations. All over the world, people trust governments every moment with the assumption that they are pious and with their help, the value of national currencies is protected. The people of the world trust banks with the assumption that they are honest trustees of their money. At every moment they rely on intermediary companies with the hope of receiving flawless financial services. But history has shown that centralized interposers can commit corruption or unintentional error. The field of decentralized finance has come to eliminate corruption, inadvertent error, and the need for centralized trust by using blockchain and the concept of decentralization.

History of DeFi

The first project that made DeFi popular was the MakerDAO lending platform, which was later followed by the Compound platform and other similar projects. Many believe Maker is a lending platform based on Stablecoin. Meerdao was the first DeFi project that was able to attract the opinion of different users. In this project, users can borrow the stablecoin of this platform called Dai. In this platform, all the processes of borrowing, lending, managing repayments, etc. are coped by cosmopolitan agreements on the Ethereum blockchain. After this project, in June 2020, another project called Compound Finance decided to reward the users who work on this project's platform. Therefore, in addition to the profit that was given to the lenders, they were also paid a portion of a new cryptocurrency called COMP. This token is also used to have voting rights in the development of this project and it can be bought and sold in different exchanges.

As the users welcomed this method, other projects did the same thing and a new movement named Yield farming was launched. In general, yield farming is the deposit of digital currencies by different users in a project, which, in addition to the profit that is given to them as a percentage, also gives them some of the digital currency of that project, which can be sold to earn more profit.

The authoritative Washington Post published a comprehensive article on decentralized finance and investment opportunities and possible risks. In September, the well-known Bloomberg magazine reported that DeFi projects account for two-thirds of the cryptocurrency market in terms of price changes. Ethereum experienced good price growth due to the increasing popularity of DeFi projects. Now that we are in 2022, DeFi projects continue to grow day by day and it seems that more users are moving towards them.

What is the role of blockchain in the implementation of DeFi projects?

Blockchain technology and digital currencies have provided the necessary infrastructure for the implementation of DeFi projects. When you make a transaction in the banking system, the transaction history is recorded in a private data center owned by the bank. With the help of blockchain technology, data is recorded in a decentralized and distributed ledger.

You may ask what is meant by a distributed ledger. Simply put, all users in a DeFi application will have a copy of the ledger. In this ledger, information about all transactions is kept encrypted. This system does not reveal the identity of users; While all transactions are clear, the real identity of the parties to the transaction is not clear.

Also, the distribution of data among users improves the security of the ecosystem. Verification of transactions is also done using users. In this way, any fraudulent exertion is averted. Proponents of DeFi claim that financial transactions are made in this situation with greater safety and transparency.

How does DiFi work?

DeFi, like cryptocurrencies, uses blockchain technology. Blockchain is an assorted and calculable database or tally. Applications called dApps are used to manage transactions and implement blockchain. In the blockchain, deals are recorded in blocks and also vindicated by other druggies. If these validators agree on a transaction, the block is sealed and encrypted, and another block is created that contains the information about the previous block.

Blocks are connected to each other in a chain through the information contained in each block and give it the name of the blockchain, and there is no way to change the blockchain. This generality, along with former protection protocols, provides the secure creation of a blockchain.

The main components of DeFi

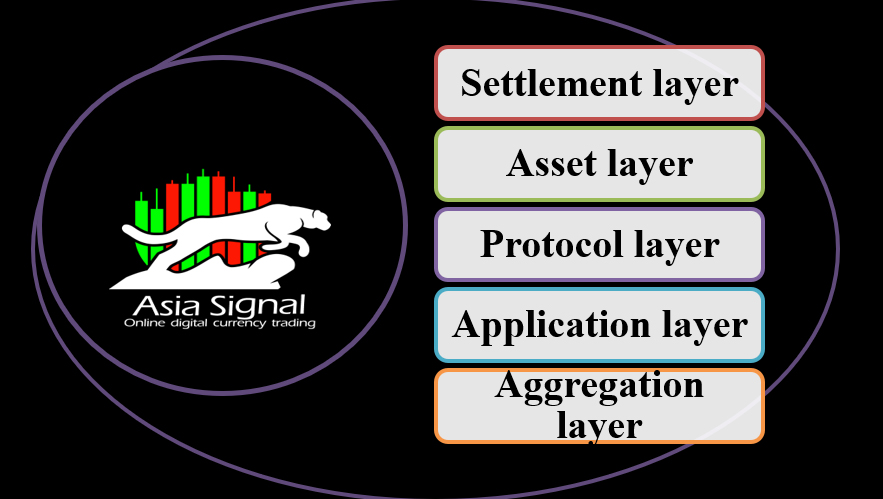

Certain blocks in DeFi create a software package where each layer is built on top of another layer. These layers work together to create DeFi and related applications that serve users in a variety of ways. If one layer is disabled, other layers are also disabled. The five layers that make up DeFi are:

1. The settlement layer is also known as layer zero because it is the main layer on which all other DeFi transactions are built and consists of a public blockchain and native cryptocurrency. One example of the settlement layer is Ethereum and its native Ether token, which is bought and sold in cryptocurrency exchanges.

2. The asset layer refers to all tokens and digital assets that are native to a particular blockchain.

3. The protocol layer is the standards and rules written to govern specific activities and is a set of principles and rules that all participants in an industry have agreed to abide by as a condition of operating in the industry. DeFi protocols are interoperable, meaning they can be used by multiple entities simultaneously to create a service or application. The protocol layer provides liquidity for the DeFi ecosystem. One of the examples is Synthetix.

4. The application layer is where the most common applications in the cryptocurrency ecosystem reside, such as decentralized exchanges and lending services.

5. Aggregation layer, this layer connects the different programs of the previous layer to provide services to investors.

How to use DeFi?

So far, we have reviewed the concept of DeFi and the main components of DeFi. In the following, we will explain how DeFi services are provided to users. To answer this question, we must refer to a concept called decentralized applications. These programs are known as Dapp among users. Decentralized programs are designed based on specific protocols.

As we said, protocols are a set of rules based on which decentralized applications are automatically governed. Protocols are the same rules that are defined in blockchain networks. For example, Ethereum can be considered the largest host of decentralized applications; Which means that many applications are launched and operated based on Ethereum protocols.

Currently, the services of some of the most widely used decentralized applications are summarized in the following topics:

1. Trading systems

Currently, all business transactions, including payments, money transfers, securities transactions, loan payments, etc., can be done with the help of decentralized applications.

2. Decentralized exchanges

Decentralized exchanges are peer-to-peer trading platforms where users directly buy and sell together and are in control of their assets.

3. Digital wallets

Digital wallets for storing cryptocurrencies are another widely used DeFi product that has been welcomed by users.

4. Stablecoins

DeFi projects are also involved in defining stablecoins. Stablecoins are defined-backed assets whose value remains constant so that users can use them to avoid volatility.

5. Lending systems

Decentralized programs aimed at paying off loans are also popular. In these programs, users can lend their assets to others and receive a certain interest in return.

6. Non-Fungible Tokens (NFT)

NFT is a type of digital asset that has a unique added value. With the help of these tokens, different assets can be valued. There are many decentralized applications to launch and sell these tokens.

The role of smart contracts in DeFi

The use of smart contracts has increased in 2020 as the DeFi industry has grown from a small sector in 2018 to one of the fastest-growing industries in the emerging technology space. Many cryptocurrencies and decentralized applications work using smart contract codes to facilitate the exchange of goods, services, data, funds, etc.

While users of centralized financial institutions, such as banks, can rely on intermediaries to manage transactions, DEPs must use smart contracts to ensure that each transaction is legal, transparent, and trustless and that the goods or services are, in fact, in line with the predetermined terms of the agreement are transferred. In short, smart contracts ensure that Party A and Party B both live up to their end of the agreement.

Smart contracts are faster, more transparent, more accurate, safer, and more efficient than traditional centralized methods of exchanging goods, services, or information. Users no longer need to rely on the black box of a centralized system, but instead, rely on rules and regulations because users can see exactly how each program behaves. These efficiencies combine to create a much cheaper way to manage the exchange of assets, goods, or services.

What does TVL mean in DeFi?

TVL stands for Total Value Locked, which is one of the important parameters in DeFi projects. This parameter shows how much capital is stored in its liquidity pools in a DeFi protocol. The higher this value is, the more users trust the project and its proper profitability.

They usually use the ratio of the "market value" of a digital currency project to the total capital locked in it to find suitable investment projects. The lower this ratio is, the higher the locked value is compared to the market value of the network, and the higher the price of the project's cryptocurrency. Note that you should never invest in a project with only one criterion.

Comparing centralized finance with DeFi

Centralized finance

In centralized finance, your money is held by banks, companies whose primary purpose is to make money. The financial system is full of intermediaries that facilitate the movement of money between parties, and each receives a fee for using their services. For example, let's say you buy a gallon of milk by using your credit card. The fee goes from the merchant to an acquiring bank, which sends the card details to the credit card network.

The network clears the fee and requests payment from your bank. Your bank approves the charge and sends the confirmation to the network through the receiving bank and back to the merchant. Each entity in the chain charges a fee for its services, usually because merchants must pay for your ability to use credit and debit cards. All other financial transactions have a fee. The loan application may take a few days to be approved. If you are traveling, you may not even be able to use bank services.

Decentralized Finance or DeFi

Decentralized finance removes intermediaries by allowing individuals, merchants, and businesses to conduct financial transactions through emerging technology. This is done through peer-to-peer financial networks that use security protocols, connectivity, software, and hardware advancements.

Anywhere you have access to the Internet, you can lend, trade, and borrow using software that records and validates financial actions in distributed financial databases. A distributed database can be accessed in multiple locations. It collects data from all users and uses a consensus mechanism to validate it. DeFi uses this technology to eliminate centralized financial models and enable anyone to use financial services anywhere.

DeFi applications give users more control over their money through personal wallets and business services. While it moves control away from third parties, decentralized finance does not provide anonymity. Your transactions may not have your name on them, but they can be tracked by entities that have access.

These entities may be governments, law enforcement, or other entities that exist to protect individuals' financial interests. One of the best ways to see DeFi's potential is to understand the problems that exist today.

What are the risks and disadvantages of DeFi?

In the previous discussions, Asiasignal experts examined the advantages of DeFi. Being a young phenomenon in the digital currency market, DeFi naturally comes with risks. Decentralized programs in finance have not yet been tested and used on a large scale, as they should be. Some of the serious risks and disadvantages of decentralized finance are:

1. Inadequate laws to protect users

In recent years, the rules in the field of Defi have progressed; But the situation is still not such that it can be claimed that users are well supported. For example, when you give your property to the bank, you are fully covered by insurance; As a result, the bank compensates for any damages. Such protective laws have not yet taken place in the DeFi market.

2. The threat of hackers

Blockchain technology has proven its effectiveness against hacker attacks to date, but we all know that nothing is certain in the supply of technology; Therefore, the risk of hacker attacks is always a potential threat in blockchain-based markets.

3. Collateral problems

To enjoy decentralized finance services, 100%, and more collateral is required. In this situation, when you intend to get a loan, you must put collateral equal to the loan amount with the loan provider. Such a procedure causes the number of people who are eligible to receive loans to be limited; This is even though, for example, to get a mortgage from the bank, you can put the house deed in the bank's mortgage, and no cash collateral is needed.

.jpg)

Advantages of decentralized financial systems:

Equal global access to financial services:

Today, many people in developed countries underestimate the importance of this issue due to easy access to financial services. While in some countries, if people are interested in financial affairs, they will not have access to them easily. DeFi has created conditions so that all people in the world, regardless of race, country, or the amount of capital they have, can have the same access to decentralized finance. The future of DeFi is very remarkable in this respect.

The low amount for international funds transfer

Another issue that may be overlooked is the cost of transferring money to other countries. This problem is most understood by immigrants who send money to their families. In traditional financial systems, many intermediaries are involved in transferring money to other countries. As a result, the transaction cost increases. But with DeFi, there is no middleman involved. Therefore, the cost of these transactions is significantly reduced and all sections of society in different countries can easily use it.

Increased security and privacy

As we said, in decentralized finance, each investor is responsible for the preservation of his capital, and financial affairs are carried out without the need for the approval of the central bank. This issue has a great impact on increasing the security of transactions and protecting the privacy of users.

Trading without censorship

In Defi, there is no bank or central institution that invalidates the transaction or does not provide financial services to some people for any reason. Transactions in DeFi blockchains are done continuously and anyone anywhere in the world with internet access can participate in these transactions.

This will greatly help countries that are dominated by corrupt regimes. The people of these countries can use this feature of DeFi for their profit so that their capital is not in the hands of the government. For example, many people in Venezuela have resorted to buying Bitcoin to keep their capital out of reach of the government.

Where are DeFi programs run?

The core of decentralized finance is the smart contract, as decentralized applications work through it. Therefore, blockchains that host smart contracts can also host DeFi applications.

While normal contracts use legal materials to specify the relationship of the people involved in the contract, a smart contract uses computer codes.

Thanks to blockchain, a smart contract will be enforceable once implemented. The developer determines the terms of the contract execution in the code, and after registering it on the blockchain, even he himself cannot stop the execution of the contract.

Using smart contracts is faster and easier and has less risk for the parties. On the other hand, smart contracts still struggle with legal challenges, and, for example, legal authorities do not yet recognize a smart contract as a homeowner. Also, since smart contracts cannot be stopped, the existence of bugs or malicious code can cause danger.

Currently, the largest platform suitable for DeFi projects is Ethereum. Without exaggeration, we can say that at the current stage, the Ethereum blockchain hosts more than 70% of the entire DeFi ecosystem.

What is the connection between Ethereum and DeFi?

Ethereum is currently leading DeFi. With the introduction of Ethereum 2, the blockchain's ability to host DeFi will be improved. Currently, there are several financial programs on the Ethereum platform, which you can see in the image below:

These programs include payment systems, exchanges, infrastructure, derivatives market, insurance service, credit service, lending, etc. Is. Ethereum's competitors in the DeFi debate are IAS and TRON, which offer higher transaction speeds and scalability.

Conclusion

Decentralized finance is a broad field that tries to provide financial services needed by people by eliminating intermediaries. With the help of this field, we can move towards a freer financial system; A system that is available worldwide and prevents corruption, censorship, and discrimination. Decentralized DeFi applications run on blockchains that host smart contracts. Ethereum is currently the largest DeFi host. DeFi's potential to shape a different future is extremely high; A future where we manage our finances without the need for banks and intermediary companies and have full control over our own assets.

Asiasignal can help you to be a professional investor in the cryptocurrency world, you can be our VIP member for more information check Crypto VIP Signal.

Comments