The financial markets are dynamic and ever-changing, driven by the actions of various participants, including retail investors, institutional investors, and market makers. Among these participants, one group that stands out for its significant influence on market movements is known as "smart money." Smart money refers to the institutional investors, hedge funds, and other large-scale players that have a deeper understanding of the markets and access to extensive resources, allowing them to make informed and strategic investment decisions.

In this article, we will explore the concept of smart money, its characteristics, and its impact on the financial markets. We will delve into the strategies employed by smart money participants, how they gather information and analyze data, and how their actions can shape market trends. Additionally, we will discuss the potential benefits and challenges for retail investors when navigating the market alongside smart money players.

Enhance your trading experience with Crypto Signal Leaks, Crypto VIP Signal, and Forex Signal Leaks – three powerful tools designed to provide valuable insights and market trends for smarter decision-making in the world of cryptocurrency and forex trading.

Understanding Smart Money: Who Are They?

Smart money refers to a group of experienced and well-capitalized investors who possess significant financial knowledge, market expertise, and access to advanced research and analysis tools. These participants typically manage large amounts of capital, making them influential players in the financial markets. Hedge funds, mutual funds, pension funds, and other institutional investors are often considered part of the smart money group.

Unlike retail investors who may focus on short-term gains or emotional decision-making, smart money investors take a more strategic and long-term approach to their investments. They carefully analyze fundamental factors, economic indicators, geopolitical events, and other critical data to make well-informed decisions.

Characteristics of Smart Money Participants

Several key characteristics distinguish smart money participants from retail investors:

Capital Resources: Smart money investors manage significant amounts of capital, allowing them to take substantial positions in various assets. Their large-scale trading can cause notable price movements and impact overall market sentiment.

Access to Information: Smart money participants have access to extensive research, data, and market analysis tools, which aid them in identifying potential investment opportunities and risks.

Sophisticated Strategies: Smart money investors employ sophisticated investment strategies such as arbitrage, derivatives trading, and hedging techniques. These strategies help them manage risk and optimize returns.

Long-Term Perspective: Smart money investors tend to focus on long-term investment horizons rather than short-term gains. They may hold assets for extended periods, which can stabilize markets and contribute to more stable price movements.

Contrarian Views: Smart money participants may take contrarian positions, going against prevailing market sentiment. Their actions can sometimes signal potential market turning points.

Strategies and Decision-Making of Smart Money

Smart money investors employ various strategies to achieve their investment goals. Some of the common strategies include:

Value Investing: Smart money investors seek undervalued assets that have strong fundamental qualities. They look for opportunities to buy these assets at a discount and hold them until their true value is recognized by the market.

Quantitative Analysis: Smart money participants use quantitative models and algorithms to analyze vast amounts of data quickly. These models help them identify patterns, correlations, and potential market anomalies.

Macro Investing: Smart money investors consider macroeconomic factors, such as interest rates, inflation, and geopolitical events, to guide their investment decisions. They adjust their portfolios based on the broader economic outlook.

Event-Driven Investing: Smart money investors analyze corporate events, such as mergers and acquisitions, IPOs, and earnings reports, to identify opportunities for profit.

Market-Making: Some smart money participants act as market makers, providing liquidity to the market and profiting from the spread between buy and sell prices.

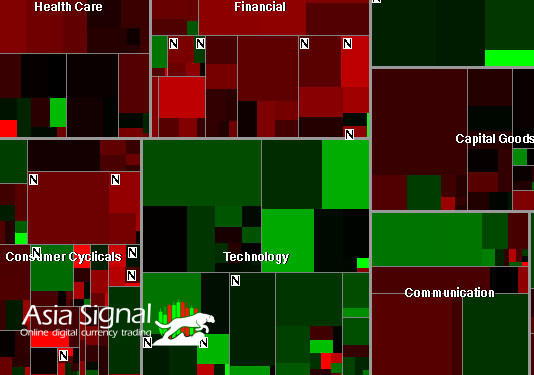

The Influence of Smart Money on Market Trends

Smart money's substantial financial power and in-depth analysis can significantly impact market trends. Their actions can create a domino effect, leading to cascading price movements in various assets. Some ways in which smart money influences market trends include:

Price Manipulation: Smart money investors with significant capital may temporarily manipulate asset prices to take advantage of price discrepancies or trigger stop-loss orders of retail investors.

Trend Reversals: When smart money investors take contrarian positions, it can signal potential trend reversals in the market. Their actions may encourage other market participants to follow suit.

Market Sentiment: The trading activities of smart money investors can shape market sentiment. A series of large buy or sell orders can influence how other market participants perceive the direction of the market.

Liquidity Provision: Smart money investors acting as market makers provide liquidity, reducing bid-ask spreads and enhancing overall market efficiency.

Investment Flows: The allocation decisions of smart money investors can influence capital flows into specific assets, sectors, or regions.

Retail Investors and Smart Money: Navigating the Market Together

Retail investors can benefit from understanding the actions of smart money participants and their influence on market trends. However, it's essential for retail investors to exercise caution and avoid blindly following the moves of institutional investors.

Retail investors have their unique advantages, such as flexibility, nimbleness, and the ability to invest in small-cap assets that may not be suitable for large institutional funds. Retail investors should conduct their research, stay informed about market developments, and develop a sound investment strategy that aligns with their financial goals and risk tolerance.

Additionally, some retail investors may choose to follow smart money's lead and use their positions as a gauge of potential market trends. However, it's crucial to remember that smart money investors may have different investment horizons and risk profiles, and their actions may not always align with the short-term goals of retail investors.

Conclusion

Smart money plays a significant role in the financial markets, with its in-depth analysis, substantial capital, and long-term approach influencing market trends and sentiment. Retail investors can benefit from understanding the strategies and actions of smart money participants, but it's essential to approach the market with a well-thought-out investment plan and an understanding of individual risk tolerance.

As markets continue to evolve and adapt, the influence of smart money is likely to remain a crucial factor in shaping price movements and market dynamics. By staying informed and making informed decisions, retail investors can navigate the market alongside smart money and work toward achieving their financial objectives.

Whether you're a seasoned trader or a beginner, these platforms offer real-time signals and analysis, helping you stay ahead of market movements and identify profitable opportunities. With Crypto Signal Leaks, gain access to accurate signals and stay informed about the latest developments in the crypto market.

Join the exclusive Crypto VIP Signal community for premium signals and personalized support from expert analysts. And with Forex Signal Leaks, make informed decisions in the foreign exchange market with reliable forex signals. Elevate your trading journey with these comprehensive signal platforms and unlock the potential for profitable trades.

Comments