Predicting the direction of cryptocurrencies prices is difficult, Cryptocurrency indicators have been developed. It is possible to predict the price of cryptocurrencies more accurately with the help of cryptocurrency indicators, which are paired with technical analysis. Cryptocurrency indicators are created using mathematical models based on historical data. In order to assist traders in making judgments, the data from the algorithms are plotted on a graph and then placed next to or superimposed on a trading chart.

Because price movements have momentum, and the more momentum we see moving in a given direction makes it more difficult to halt, cryptocurrency indicators can't always accurately anticipate how the price will move. The use of charts and formulae in cryptocurrency indicators helps investors see what buyers and sellers are likely to do next.

Let's get started with the greatest cryptocurrency indicators for crypto traders right away.

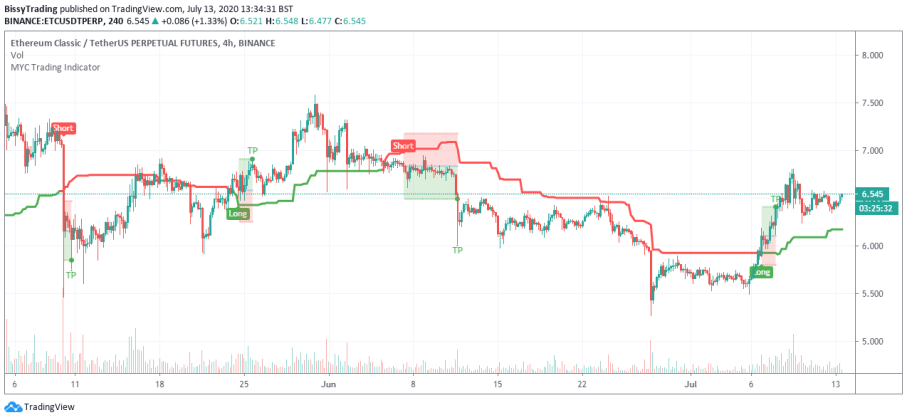

MYC Indicator for Trading

MYC

As a proprietary indicator, the MYC Trading Indicator makes use of both trend analysis and momentum oscillators to assess if a cryptocurrency is headed in the direction of a bullish or bearish trend.

A long signal is created when the price crosses above the trendline; a short signal is generated when the price crosses below it. This is a key characteristic of the indicator. Instead of relying on the RSI or Bollinger Bands, this indicator provides an entry and exit point so traders can focus on selecting the size of their position or leverage.

Following are the trading pairs that can benefit from the indicator's use, as well as its return percentages and accuracy:

BTC - Return: 200%, Accuracy: 70%.

In terms of returns, ETH has a 70% accuracy rate.

In this case, the return is 250 percent, and the accuracy is 70%.

Accuracy: 75 percent, Return: 100%

For example, ETC—the return of 350 percent, 70 percent accuracy

One hundred and fifty-percent return with seventy-percent accuracy

Accuracy: 90%, Return: 650,000% – TRX

The return is 350%, and the accuracy is 90% for the LIN

How to Use:

You don’t have to be a skilled and professional trader to use the MYC Trading Indicator.

If you have Telegram, you can contact the admin by sending a message to: @MYCSupportBot, who will enable you access to test the indicator. If you don't have Telegram, you can also send an email to [email protected] to begin the conversation.

Secondly, you can join MYC Signals, a free crypto signal group, to watch the indicator in action by receiving live trades.

Relative Strength Index (RSI)

With the RSI indicator, traders may see when crypto's price is too far from its "real" value, allowing them to profit before the market automatically corrects itself. It was developed over 40 years ago by technical analyst Welles Wilder. The RSI indicator has shown to be a useful tool for traders in the turbulent crypto markets over time, allowing them to identify excellent entry positions into trades.

Bitcoin's overbought/oversold status can be determined using the RSI, which applies a complex calculation to the data. The method yields a number ranging from 0 to 100, which can be plotted on a graph as an oscillator – a wave pattern.

RSI equals to 100 − 100 / (1 + RS)

The Relative Strength Index (RSI) is defined as the average of the closing prices of the preceding X periods.

However, if you like, you can select any number between 1 and 14.

When the RSI falls below 30, an asset is said to be oversold or undervalued. RSI readings of more than 70 indicate that the market is overbought.

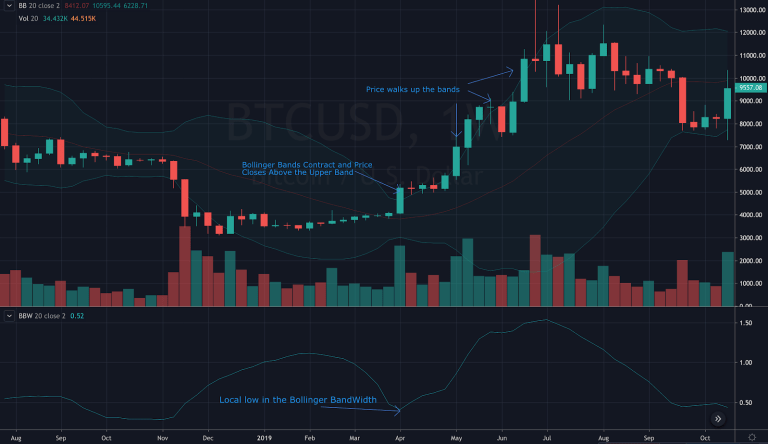

Bollinger Bands

Bollinger Bands

It was developed by financial analyst John Bollinger in the 1980s and is used today by traders for technical analysis. As oscillator indicators, they show when the market is overbought or oversold and when volatility is high or low.

The main objective of this indicator is to display the price volatility as compared to an average. As the name implies, these bands consist of a moving average line (the "Bollinger line") and a "lower band." Prices in the two outer bands are reflected in the bands themselves. When volatility is strong, they spread out (move away from the middle band) and contract (move closer to the middle band) as a result.

The centerline of standard Bollinger Band calculations is a 20-day SMA (SMA). The upper and lower bands are derived from the market's volatility.

Simplified moving average over the past 20 days: (SMA)

The 20-day SMA plus (20-day standard deviation x2)

Lower band: SMA of 20 days – (20-day standard deviation x2)

In this case, at least 85% of the data moves between the upper and lower bands, which can be altered depending on the trading strategy and demands of the individual user.

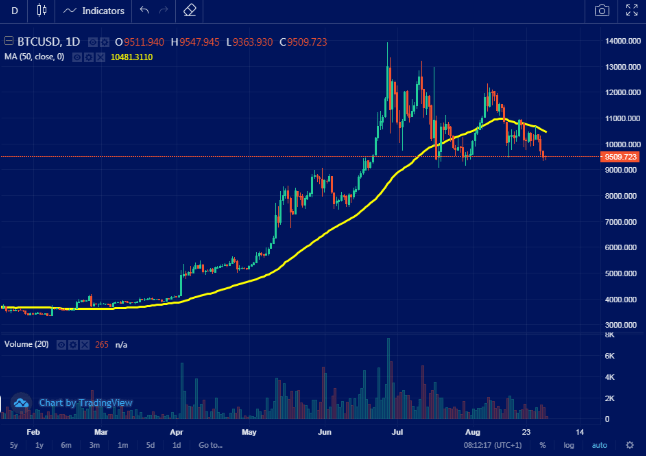

Moving Averages (MA)

Moving Averages, one of the Cryptocurrency indicators

The Moving Average indicator is considered one of the Cryptocurrency indicators used to smooth out price movement over a specified period of time. Lagging indicators are those that take into account previous price movements, and the MA is no exception. Moving averages can be divided into two categories: basic and exponential. The MA you choose as a trader depends on your own personal trading strategy. Short-term traders should go with a shorter MA when it comes to trading, while long-term traders should stick with a longer MA. MA can operate as a support or a resistance in the trading world.

Moving Average Convergence/Divergence (MACD)

The moving average convergence or divergence (MACD) is one of the most often used Cryptocurrency indicators for trading. This is because of its ease of use and the potential to generate significant crypto trading signals. Trend-following indicator MACD shows whether the short-term price momentum is moving in sync with the long-term price momentum and in circumstances when it isn't utilized to evaluate whether a trend change has occurred. A signal line, zero line, and histogram all make up the MACD's four components.

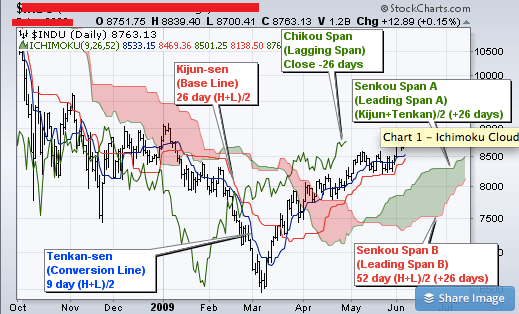

Ichimoku Cloud is considered one of the most useful Cryptocurrency indicators

Ichimoku Cloud

There are five different lines in the Ichimoku Cloud indicator, and each line shows the average price for a certain period that the trader sets. To put it another way, they're among the most easily recognizable cryptographic signs. Furthermore, they clearly identify support and resistance, determine trend direction and momentum, and provide a variety of trading signals.

Clouds are formed when two lines cross because the region between them is shaded. This means that if the price is above the cloud, the trend is up, and if the price is below the cloud, it's going in the opposite direction. If the price is traveling in the same direction as the cloud, then there is a strong trend.

Our signals are provided by using the above indicators and their results are guaranteed. So, rest assured that you can enjoy prosperous trading with them.

Comments