The Enigma of the Dead Cat Bounce: A Tale of Market Resilience

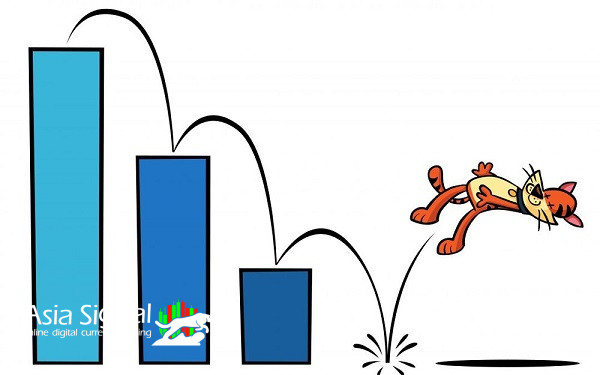

In the world of finance, where uncertainty often reigns supreme, traders and investors are constantly searching for patterns and signals that can help them navigate the tumultuous waters of the markets. One such phenomenon that has captured the imagination of financial analysts and market enthusiasts alike is the "Dead Cat Bounce." This term, evocative as it may be, refers to a brief, yet misleading, uptick in the price of an asset or security following a significant decline. In this article, we delve into the intricacies of the Dead Cat Bounce, exploring what it is, how it works, and its implications for investors.

The Origin of the Term

The origins of the term "Dead Cat Bounce" are shrouded in folklore, but it's generally believed to have emerged from the grim world of Wall Street. The metaphorical image of a dead cat bouncing off the ground might not be pleasant, but it aptly describes the phenomenon it represents. Imagine a situation where a cat falls from a great height – upon impact, it may appear to bounce upward momentarily before succumbing to gravity once more. In the context of the financial markets, this metaphor captures the essence of a brief, counter-trend rally that occurs after a substantial decline.

Understanding the Dead Cat Bounce

A Dead Cat Bounce occurs when an asset experiences a sharp and prolonged decline in price, only to see a short-lived rebound before resuming its downward trajectory. This phenomenon can be observed in various financial markets, from stocks and cryptocurrencies to commodities and real estate. While it can be a tempting sight for traders and investors looking for a quick profit, it's essential to recognize that the bounce is typically a temporary reprieve rather than a sign of a genuine reversal.

Key Characteristics of a Dead Cat Bounce:

1. Sharp Decline: A significant and often rapid drop in the asset's price precedes the bounce. This decline typically triggers panic among investors and may be driven by various factors, including economic events, market sentiment, or company-specific issues.

2. Short-Lived Rally: The bounce is characterized by a relatively brief period of price recovery, which can range from a few days to a few weeks. During this time, some investors may interpret the rally as a sign that the worst is over.

3. Volume and Momentum: The trading volume during the Dead Cat Bounce is usually lower compared to the volume during the initial decline. This lack of strong buying interest and declining momentum are warning signs that the bounce may be unsustainable.

4. Resumption of Decline: After the brief uptick, the asset's price typically continues its downward trajectory. This is the point where the "dead cat" metaphor comes into play, as the temporary bounce gives way to the prevailing bearish trend.

Implications for Investors

Understanding the Dead Cat Bounce is crucial for investors, as mistaking it for a genuine reversal can lead to significant losses. Here are some key takeaways for investors:

1. Don't Be Deceived: Be cautious when you observe a sudden price increase after a substantial decline. While it may be tempting to buy in at this point, it's essential to conduct thorough research and consider the broader market context.

2. Use Additional Indicators: Rely on technical and fundamental analysis, along with other indicators, to confirm whether a bounce is genuine or a dead cat. Look for signs of sustained buying interest, improving fundamentals, and positive market sentiment.

3. Risk Management: Implement risk management strategies such as stop-loss orders to limit potential losses if the bounce turns out to be short-lived.

Conclusion

The Dead Cat Bounce is a fascinating yet treacherous phenomenon in the world of finance. It serves as a reminder that markets are inherently unpredictable and subject to abrupt shifts in sentiment and momentum. While the allure of a quick rebound may be strong, investors must exercise caution, conduct thorough research, and rely on a combination of indicators to differentiate between a dead cat bounce and a genuine market reversal. In the ever-evolving landscape of finance, understanding this phenomenon can help investors navigate the complexities of the market with a more discerning eye.

Asiasignal is The Best Forex Signal Provider for you.

Comments