If you know what to do to achieve your goals, You have a plan. Furthermore, if you know what not to do, you have a strategic plan or strategy. Therefore, determining the investment strategy and risk level is crucial to its success. Everyone in the cryptocurrency market is looking for the best cryptocurrency trading strategy. The cryptocurrency market has a lower market value or market cap than other financial markets. Therefore, Bitcoin whales can easily create significant fluctuations in this market.

Therefore, traders should constantly monitor the movement of market whales in their trading strategies. For digital currency trading, like other financial markets, one should pay attention to the trends and levels of support and resistance in technical analysis. For example, a trader who trades in the financial markets must look at the fundamental analysis of companies' stocks. In the digital currency market, along with technical analysis, traders need fundamental analysis for a successful trade. Considering the technology-oriented nature of digital currencies, paying attention to the cryptocurrency project and the technology used, among other factors, can help the trader better analyze digital currency’s price. In this article, we will examine strategies in digital currency trading that can lead to a successful trade.

In this article from Asiasignal, we will explain the investment strategy in investment funds efficiently and inefficiently and the types of investment strategies. An investment strategy can influence the approaches of funds and financial institutions.

It's better to use futures signals for predicting the future of cryptocurrencies; for futures signals, you can check the website of Asia Signal and Join our Crypto VIP signal and use the crypto signals.

What is wealth management?

Capital management is a broad term that encompasses services and solutions across the entire investment industry. In the digital currency market, consumers have access to various resources and applications that allow them to manage almost every aspect of their finances individually. As investors' net worth increases, they often seek the services of financial advisors for professional money management. In the meantime, different strategies for investing in the digital currency world have caused people to need clarification about choosing the best strategy. One of the things that help every trader is the efficiently inefficient strategy; according to this, you can assess all kinds of strategies that the most successful traders have used and examine why these strategies are inefficient.

To be aware of the newest indicators and use the best indicator crypto, you can subscribe to Asia Signal's Crypto VIP signal channel. Check Crypto VIP Signal's membership terms and conditions.

What is efficiently inefficient?

Efficiently Inefficient refers to the trading strategies used by financial funds or traders and describes the secret world of successful investors. Lasse Heje Pedersen, the author of the book Efficiently Inefficient, is an expert economist who, in his latest research, interviews financial fund managers to introduce a variety of trading methods to generate income and also deals with the inefficiency of these strategies and all these cases are included in Efficiently Inefficient. It will cause profit or loss.

If you want to be a professional investor, you can use some signal leaks; you can check Crypto Signal Leaks on Asia Signal web and join our crypto VIP signal channel to use the latest signals.

What is the importance of efficiently inefficient in digital currency?

Buying and selling digital currencies for profit is called trading. Buying and selling in financial markets are always associated with many risks and dangers. One financial market that has attracted the attention of many large companies is the digital currency market. Due to the fact that this market has a lower market cap than other global markets, it has more volatility, and it is necessary to use appropriate strategies in the cryptocurrency market to gain profit and prevent possible losses. Using efficiently efficient digital currency trading makes us avoid emotional decisions.

Decisions based on emotions, fear, and greed increases the possibility of mistakes in analysis. Therefore, the most important advantage of using this strategy in digital currency may be that it removes you from the influence of emotions and irrational thinking as much as possible. In order to use it efficiently and inefficiently, it will be very effective to know some mathematical topics. In the rest of this article, we will identify these topics from Asia Signal.

You can get help from Asia Signal experts for the best indicator use. You can be an Asia Signal VIP member by joining our Crypto VIP Signal channel and getting acquainted with the leaked crypto signals group.

What is the Average Return?

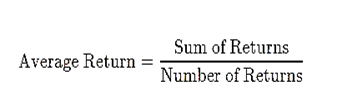

The average return is the simple mathematical average of a series of returns generated over a specified period. The average return is calculated in the same way as the simple average is calculated for any set of numbers. The numbers are added together into a total; then, the total is divided by the number of digits in the group.

The average return on investment

There are several return metrics and methods for calculating them. We take the sum of the returns for the average return and divide it by the number of returns.

The average return tells the investor or analyst how much the return of stocks or securities has been in the past or how much the return of a group of companies has been. The average return is different from the annual return because it ignores compounding.

Remember to use Binance Spot Trading Signals; check the Asia Signal VIP crypto signal telegram for more information!

Calculate the average return from growth

The simple growth rate is a function of the beginning and ending values or balances. It is calculated by subtracting the final value from the initial value and then dividing it by the starting value. The formula is as follows:

Who uses efficiently inefficient?

But the question for many people is whether successful people in the digital currency market use inefficiently inefficient and who these people are. These people have provided many services in this field since the emergence of cryptocurrencies and have earned much capital from these services. In the following, we will introduce people who could be rich in the financial markets by using the efficiently inefficient strategy.

Remember to use Crypto Signal Leaks; check the Asia Signal VIP crypto signal telegram for more information!

5 of the most successful cryptocurrency investors who have used the efficiently inefficient method:

1. Satoshi Nakamoto

The person who made an economic revolution in the world by creating Bitcoin was Satoshi Nakamoto. In 2008, Nakamoto introduced Bitcoin to the world, causing a significant change in the global economy. But after the creation of Bitcoin, Satoshi became an unknown person, and there is no information about his identity. If we do some research, we know that he is a genius. But the question that arises is how Satoshi is a rich person when no one even knows him. Undoubtedly, the person who created Bitcoin has a lot of Bitcoins. According to the evidence, the existence of a wallet in his name shows that Satoshi Nakamoto has about 980,000 Bitcoins. This person has been able to reach this position by examining various strategies and using them efficiently and inefficiently in the financial fund.

Remember to use Binance Spot Trading Signals; check the Asia Signal VIP crypto signal telegram for more information!

2. Changpeng Zhao

But let's go to a person who has contributed a lot to digital currencies and became a rich person in the digital currency market with the digital currency exchange he built. This 44-year-old person was born in Jiangsu, China, and has Canadian nationality. The many problems of Zhao's family made him work at gas stations and McDonald's hamburgers. Zhao was able to enter the university despite all the difficulties. Zhao had chosen the field of computer science at McGill University in Canada. He was also fluent in English, Chinese, French, and Japanese. Zhao's life changed after he graduated from university. Zhao's first official activities started at the Tokyo stock market; When he started building trading programs.

Even his access to New York was opened, and Changpeng Zhao could design futures trading software inside New York. But in the beginning, Zhao's familiarity with digital currencies began when he played poker in 2013, making him interested in digital currencies.

During this time, Zhao met famous people such as Roger Ware, and after that, he became the chief technology officer at OKCoin. But after some time, Zhao decided to start his own company, a company where all users can buy and sell using the program and can trade with cryptocurrency pairs. In 2017, the Binance exchange started working, and Zhao, known as CZ, was able to launch the most prominent digital currency exchange. Zhao, who has now managed to have the most prominent digital currency exchange, considers one of the keys to his success to being efficiently inefficient.

Binance spot trading signals are perfect signals for trading. You can be Asia Signal’s VIP member and use binance futures signals.

3. Brian Armstrong

A 35-year-old person who has acquired much capital in the digital currency market in recent years and become a rich person. Brian was born in California in 1983 and started learning Java programming language in high school, and from that time, he became interested in computer technology.

In 2001, Armstrong started studying at the university in two fields computer science and economics. After graduation, Brian traveled to Argentina and lived in Argentina for a year. Before learning about digital currencies, Brian worked in various companies such as IBM and Airbnb. But Brian wished to become a technology giant, and after learning about Bitcoin, he decided to establish the Coinbase exchange with Fred Arsam in 2012.

For better trading and crypto signals, you can be an Asia Signal VIP member and access the Futures Signal; check the Asia Signal VIP crypto signal telegram.

4. Winklevoss twins

Tyler and Cameron Winkle-Voss were twins born in 1981 in Southampton. Tyler and Cameron entered Harvard University in 2000 and graduated in 2004 with business degrees. In 2002, the Winklevoss twins created a social program similar to Facebook. But Mark Zuckerberg broke the idea of twin brothers by creating Facebook. The Winklevoss twins also filed their lawsuit against Zuckerberg because they claimed they first shared this plan’s picture with Mark.

Mark Zuckerberg also agreed to give 11 million dollars to the Winklevoss twins. After receiving the amount from Mark Zuckerberg, these two brothers invested in BTC currency, and the capital of these two brothers is estimated to be around 6 billion dollars.

It's better to use futures signals for predicting the future of cryptocurrencies; for futures signals, you can check the website of Asia Signal and Join our Crypto VIP signal and use the crypto signals.

5. Michael Novogratz

Michael Novogratz is the CEO of Galaxy Digital and co-founder of Galaxy LP, a New York-based commercial bank. In 2017, Michael said that about 20% of his net worth was invested in Bitcoin and Ethereum.

He said about buying bitcoin that one of his friends called me and asked me about bitcoin and said that there is much talk about this cryptocurrency on the west coast, where he moved. Michael said after the conversation, I also searched for 15 minutes about digital currency and understood the Bitcoin algorithm and blockchain.

Novogratz also mentioned that after searching and researching cryptocurrencies, I realized that they could spread and be used by libertarians. This happened in 2013 when there was an economic crisis in Europe, and the Chinese made many purchases in this area. Michael, who researched more about this technology, became more interested in him and decided to talk to his investment partner about these issues; He called Dan Morehead and said to do some research on Bitcoin and take a look at it, but Morehead said he didn't have time.

But after two weeks, Moorhead called Michael and said he would change the world. So start deciding to invest in this type of exchange. Michael claimed that he bought Bitcoin when it was $95. Michael had claimed that at that time, Bitcoin would reach $1000, and this had caused his name to be used in the Financial Times newspaper. He had said it was clear to me that Bitcoin would reach $1000, And bitcoin would reach 1100 dollars. Michael decided to sell his bitcoins, but his partner prevented him from doing so.

You can join the Asia Signal VIP crypto signal telegram to have the best future signals and indicator crypto.

Conclusion

Breaking the price range can also cause profit. In this case, the price may break its content from below and go below the support line. In this case, the trader can profit from this downward trend by opening a short position. Breaking the price range can also cause profit. In this case, the price may break its content from below and go below the support line. In this case, the trader can profit from this downward trend by opening a short position. So there may be efficiently inefficient situations, and you can get profit by choosing the right strategy.

Asia signal experts can help you to have the best investing; You can be an Asia Signal VIP crypto signal telegram member by joining our Crypto VIP Signal channel and getting acquainted with leaked crypto signals group and crypto indicators and crypto signals as soon as implicit; for further information, check the Asia Signal VIP crypto signal telegram.

Comments