Definition of trading

Trade is derived from Middle English trade, which means "route, course of behavior," Middle Low German trade, which means "track, course," Old Saxon trade, which means "spoor, track," and Proto-Germanic *trad, which means "track, way," and is cognate with Old English tredan ("to tread").

Transporting commodities and assistance from one individual or organization to another encompasses exchange, often in trade for money. A system or network that permits trading is referred to as a market by economists.

Compared to investing, which uses a buy-and-hold approach, trading involves active engagement in the financial markets. The ability of a trader to be profitable over the long term is a prerequisite for trading success.

Anyone who participates in the buying and selling of financial assets on any financial market is a trader. They can buy or sell on behalf of another person or organization. The length of time an investor or trader hangs onto an asset is the main distinction between them.

A trader is a person who buys and sells equity in the short-term for an institution or its benefit. The costs of paying brokers in the form of various commission rates and capital gains taxes, which apply to trades, are two drawbacks of trading.

Trade is a basic economic notion that involves the exchange of goods and aid as well as expenditure from a consumer to a dealer. Additional aim of trading is when two receptions exchange goods or assistance. Within an economy, the exchange can take place among creators and customers.

Trading refers to "exchanging one thing for another." Typically, we interpret this as just purchasing by trading products for cash.

The same idea applies when discussing trading in the financial markets. Consider someone who transacts in shares. In reality, they are purchasing stock (or a small portion) of a corporation. They make money by reselling those shares at a higher price if the value of those shares rises. It is trading. You purchase something for one price and then resell it for another, ideally at a higher price, making a profit.

But why would the share price increase? The answer is straightforward: supply and demand determine how much something is worth by deciding how much others are prepared to pay.

It can be explained using the straightforward, real-world example of purchasing food. Imagine you are in a market, and a vendor has just ten apples remaining. The sole location where apples are sold is here. The market stall owner will probably sell you a few apples at a fair price if you are the only customer and need a few.

Let's say fifteen people come into the market, and they are all looking for apples. They are prepared to pay more for them to guarantee that they will obtain them before the others. As a result, the owner of the market stall can raise the price because he is aware that there is a greater need than supply for apples.

Customers will quit purchasing apples once they reach a price point where they believe them to be too pricey. When the proprietor of the market stall realizes that his apples are no longer selling because they are too expensive, he will cease raising the price, and it might decrease once more to a point where customers will start to purchase the apples again.

Imagine that an additional market vendor enters the marketplace at that moment with even more apples to sell. Apple's supply has now considerably risen. It makes sense that the proprietor of the second market stall could try to draw people by offering apples at a lower cost than the proprietor of the first market stall. It also makes sense that people would desire to purchase at a cheaper cost. When the initial stall owner notices this, they will probably lower their prices. As a result, the price of apples has decreased due to the rapid rise in supply.

The "market price" is the price at which supply and demand are balanced; in other words, it is the price at which both the owner of the market stall and the clients agree on the price and the number of apples to be sold.

In the world of finance, supply and demand are the same ideas. More people desire to purchase shares of a company if it reports excellent profits and is giving out excellent dividends. The price of such shares will rise due to the increased demand.

In this case, they will trade using the company's funds and credits. Traders who work for financial institutions are compensated with a mix of bonuses and salaries. Traders also have the option of working for themselves by engaging in trading using their funds and credit. However, they will also keep the profit for themselves if they choose this course.

Online Trading

Online trading is the practice of purchasing and selling securities over a network of computers or other electronic devices, such as touch-tone phones, wireless connectivity, and other modern technology. Customers typically use their regular Internet Service Provider to visit a brokerage firm's website when trading online. Customers can access the Web Site's information there and sign into their accounts to place orders and check the status of their accounts after arriving.

Online investing is making orders to purchase and sell stocks through the Internet instead of placing orders by speaking directly with a broker over the phone. Day trading is a type of trading method where a person buys and sells the same security quickly (typically on the same day), hoping to profit from slight changes in the security price.

Online trading is a reasonably expected way to buy and sell financial products. Online brokers offer various financial instruments, including futures, ETFs, commodities, bonds, and stocks.

A more straightforward digitalized variant of offline trading is online trading. It involves purchasing and peddling properties utilizing an online trading platform delivered by a brokerage. Since stocks, bonds, mutual funds, ETFs, futures, and currencies may now be exchanged online, internet trading has opened up a wide range of alternatives.

Any trader or investor can have their trade executed by brokerage firms. Typically, a bank account and a Depository Participant are connected to an online trading account (one your broker has a tie-up with). The speed at which transactions are carried out and concluded while trading online is a significant advantage. The entire procedure is much quicker because everything is digital, and there aren't any physical documents to copy and file. With the ability to search and compare prices across numerous databases, transactions may be completed in a matter of seconds. The exchange that offers the best price is matched, and both the buyer and the seller receive confirmation.

Traditionally, a buyer would phone his brokerage corporation and inquire to fill in a plea to buy stocks of a specific organization for a certain quantity when he liked to finance money in stocks. The broker would then substantiate the order and notify him of the stock's call rate. The order would be placed on the stock exchange when the user confirmed his trading account, the broker's fees, and the time necessary for the order.

It should be clear that this procedure required a lot of stages and was drawn out. It is not surprising that internet trading platforms have dominated the trade industry due to their benefits:

Users can create, manage, and close accounts while working from home using an internet-connected device. Making transactions is now a lot simpler. A variety of financial items that were previously only available from specific locations or banks can directly be purchased and sold online, which also lessens the need for an intermediary and saves time. The money utilized is actual money, and the user has the opportunity to research and select among the many stocks and goods that are offered.

Retail trading still has a role in local stock exchanges and offices, despite online trading spreading its roots deeper and deeper into the current trading industry. With the development of computers and the internet over the past twenty years, there has been a clear shift toward online trading over offline trading. Several benefits to online trading are harder to obtain offline.

The price of stocks and other financial items has considerably decreased. Many traders and investors are drawn to online platforms since they offer a far more affordable experience. This has been made possible by eliminating most intermediaries in online trading, which reduces the additional cost of commissions on these products.

Compared to offline trade, online trading moves along considerably more quickly. Additionally, when information is being transmitted electronically, it is simpler to determine the price of shares. It is simple to trade shares when you receive price notifications containing information about price fluctuations. Consequently, the processing time is cut down. Additionally, it makes it possible to buy goods anywhere in the world. As a result, it's not required to travel to a specific location to trade.

Differences between online and offline trading

Ease of Trade

Unlike offline trading, when the broker handles all transactions, online trading is done individually—the individual wishes to make all decisions without reference to or influence from any other source. In the modern world, online trading is also more practical because it can be done on any device. Transactions can be completed in seconds with just an internet connection. On the other hand, for confidential transactions in offline trading, a person had to go to the broker's office and make careful phone calls. It furthermore makes offline trading extra costly as the brokers arrest a considerable percentage to accomplish these deals.

Convenience

The convenience of the individual should be taken into consideration when choosing online or offline services. Online trading is a fantastic alternative if you have access to a laptop or mobile device, constant internet connectivity, and are tech-savvy enough to follow the stock markets from anywhere.

However, if you wish to engage in online trading, being without an internet connection can cause problems. Then, your most fantastic option for conducting transactions is over the phone. For those who value customized assistance and ongoing counsel while considering any transaction, offline trading is a fantastic option. A specialist's opinion might occasionally be comforting. Still, a lot depends on the type of broker you operate with.

Security

Online trading is quite protected because each trader has entire custody over all deals. On the other hand, in offline trading, brokers may execute trades on the client's behalf without the client's awareness. The client's account could suffer as a result.

Real-time Information

A trader requires constant access to real-time information, including updates on any stock market crashes or booms, to conduct trading effectively. All of this real-time information is shown on a user-friendly platform which is a significant advantage of online trading. In this respect, trading offline puts you behind because the market constantly changes. The time it takes to place a call, hit trade, and then complete the transaction is longer.

Which type of trading is better?

One might conclude that internet trading is a vastly superior option after reading an essay that nearly destroys offline commerce. Since the advent of the internet, business has evolved, and the financial sector now operates virtually entirely online. Online trading is much more promising now that everything is conveniently located on a single platform and accessible with just a few clicks. However, historically, India has been a nation that is overrun with offline brokerage firms. Fewer people were using the internet, and getting in touch with an experienced broker who can offer helpful advice always carries a certain level of comfort.

Due to the abundance of internet trading platforms, the rivalry between them benefits the trader or investor. These platforms release offers and discounts that allow users to buy products for less money or sell them for more money, ultimately helping the users. This is being done for better marketing and to attract more users. Occasionally, this occurs in offline trading.

Online trading is electronic exchange administered hiring a computer and the internet. The customer can search for stocks traded on many exchanges and select the broker that provides the best price and easy trading. You can start putting different kinds of share trading orders after choosing a trading platform. The stock order is kept in a database, and after the buyer and seller have verified it, the money transfer is carried out.

These platforms offer a variety of promotions to attract customers, which ultimately benefits the users greatly—something uncommon in offline trade. The main effects of internet trading are decreased product costs, diminished intermediary roles, greater broker competition, etc.

Before the advent of online trading, traders had to phone their brokerage firms and place "buy" and "sell" orders to execute trades. It was an extremely time-consuming process that naturally led to several issues. Surprisingly, a small number of individuals continue to engage in offline trading today.

However, the bulk of traders have switched to online trading platforms since the internet's introduction in this digital era. You can read news about companies, view the list of securities currently held through the dashboard, place "buy" and "sell" orders, place market limits, set a stop-loss, check the status of an order, and more. You also have access to all of your previous investment statements. For both traders and investors, online trading has decreased costs.

Benefits of online trading

You can purchase and sell without speaking to your broker, cutting out the intermediaries. Because of this, online trading can appeal to traders who lack the resources to use full-service brokers.

It's quicker and less expensive: You pay more money when a broker performs your trades. From another perspective, a brokerage payment is evaluated when you trade online, but it is constantly smaller than what an ordinary broker who must physically order the trade would charge you. Trading online happens almost instantly.

It gives investors more control: You have more control over your money thanks to internet trading, which is one of its key benefits. With online trading, you can deal any time you prefer during trading times and formulate your own determinations independent of the broker's impact.

Real-time investment tracking is possible: To track your investing success and conduct independent research, your online trading platform includes a wealth of sophisticated tools and interfaces. As you log in utilizing your phone or PC, you can survey increases or damages in the moment.

When you purchase or sell stock online, your request is carried out immediately. However, a lot of things happen in those seconds that you are oblivious of, like:

Your order has been received.

A database is populated with your order.

When a buyer and a seller are found, the system looks for a seller. A confirmation message is then sent to both parties.

The price and the order are disclosed to the oversight organizations. These oversight organizations keep an eye on all trading operations and make their findings public to all investors.

If regulators need to review your prior transactions, your trading records are kept.

Your broker who sold the shares and those who purchased them receive contracts.

Following all this, the brokers have three days to swap the money and stock, a process known as settlement.

Following this procedure, the cash or shares are now formally in your account.

Users can access and manage their trading accounts for their chosen financial markets through trading platforms. This aids users in keeping up with their performances. Brokers typically provide these platforms for a fee or a discount on transaction commissions. Many platforms are now accessible for free, or rather, access to the media is included in the brokerage fee you pay, thanks to the development of the discount broking business. These systems can be used for user authentication, research, order placement, data storage for past trades, and keeping track of the many financial goods you want to trade in. E-trading, or internet trading, is now possible thanks to trading platforms.

Stocks, commodities, derivatives, bonds, and other trading products are among those you can buy using these platforms. These products are traded on the stock market between traders with the help of intermediaries like investment banks, stock exchanges, brokers, and market makers. Establishing a communication network between the many intermediaries and the traders enables the efficient operation of the entire system.

An initial public offering (IPO) is when a firm sells shares of its stock to the general public for the first time. The value of a company's stock depends on its financial health and the state of the economy.

Simply put, a broker is a qualified individual that you can work with to acquire and sell these stocks. An online platform serves as an online broker when you use it. A brokerage corporation may be called by a person who hopes to pay for any property. They would execute an injunction and notify him of the product's current market pricing. If the investor is eager, they will refine the order ahead and subtract a commission for themselves. If the stoner expects to buy stock, the broker will transmit his order to a stock exchange. This process, which includes exchanging funds between the broker and the investor, will take about three days.

Websites for online platforms provide users with options and the available stock they want across all available platforms. Any orders her places are recorded on a database. The user receives his supply, in the form of money, deposited to his trading account after the trading account and payments are confirmed. Thank God for online trading. Trading on the internet is significantly more straightforward. By joining an internet trading platform, one can purchase and sell stocks. Nowadays, there are numerous internet-based brokers, making it simple and hassle-free for everyone to buy and sell.

Forex VS Crypto

Online trading is increasingly common these days, and there are numerous platforms and exchanges available for doing so. as stocks, forex, and cryptocurrencies. Both of these last ones are highly recognized and strikingly similar to one another. Accordingly, we shall go into further depth into them.

Trading in cryptocurrency has gotten more popular over the past few years as we go through a "digital" gold rush of new technology and creativity. The market value of all cryptocurrencies has risen past $3 trillion due to increased investment in digital currencies.

Traders have become interested in the speculative rise of blockchain technology and its several cryptocurrencies because they don't want to miss out on big profits.

In contrast to forex (FX) markets, where currency exchange prices barely fluctuate, this is a significant distinction. The appeal of forex for traders is due to its leverage.

Despite having completely different fundamentals, currencies and cryptocurrencies still use supply and demand to establish prices.

The buying and selling of currency pairs in a regulated market open around the clock is known as forex trading. The purchase and sale of digital assets, such as coins, tokens, and non-fungible tokens (often referred to as NFTs), in centralized and decentralized marketplaces with a minimum of regulation is known as cryptocurrency trading.

While there are currently some countries and businesses that accept cryptocurrency for regular financial and purchasing transactions, this is starting to change as cryptocurrencies become more widely accepted. Foreign currencies are accepted as legal tenders worldwide, despite some country restrictions.

Despite being a relatively new asset class in the financial sector, cryptocurrency provides traders with a far wider variety of chances to purchase and sell.

The overall number of coins, including the most often exchanged, is over 17,000, according to CoinMarketCap.com. These are Cardano, Solana, Binance Coin, Ethereum, and Bitcoin. Despite a significant number of new entrants, Bitcoin still has the highest market value, the largest user population, and is the most widely used of all the coins. For instance, several businesses have begun to take Bitcoin. Three currency pairs can be traded on forex: major, minor, and exotic. Compared to their little and unknown counterparts, the major currency pairs, such as the EUR/USD, EUR/GBP, and AUD/USG, have a lot of liquidity and are less hazardous.

Although there is an obvious winner in this situation, one must be aware that the chance to increase one's wealth through trading carries a significantly increased risk. Trading cryptocurrencies have a much higher chance of being profitable, and some people have made billions of dollars doing so. The "Bitcoin Billionaires" are those who prevailed. There are numerous possibilities to profit from the consistent flow of initial coin offerings.

While the amount of profit from trading may be constrained by the forex market's relatively moderate fluctuations, unexpected loss risks are kept in check. Trading cryptocurrencies offers more significant financial potential than forex because it requires less capital. Crypto may be the right choice if you're seeking a quick way to make money.

Most forex trading is done through brokers providing relatively simple open online accounts. Several forex trading platforms are available, each with a particular set of costs and requirements.

Decentralized or centralized platforms can be used for cryptocurrency trading. Other traders favor decentralized systems because they may deal anonymously and without an intermediary. To create a more secure environment, some people employ centralized exchanges.

There are similarities and contrasts between cryptocurrency and FX trading. The exchange of digital assets, including cryptocurrencies, tokens, and NFTs, is known as crypto trading (non-fungible tokens). Trading in forex is exchanging one fiat currency for another in the hopes that the value of the new currency will increase and allow the trader to convert it back for profit.

Similar forces, such as supply and demand, govern the pricing of cryptocurrencies and fiat money. However, the distinct facets impacting on supply and demand in FX and crypto are extremely various.

For instance, blockchain technology, which uses a distributed and decentralized ledger, powers cryptocurrencies. As a result, significant money is being invested in this new infrastructure, and demand for cryptocurrencies is skyrocketing.

Trading currencies on the forex market is completely pitting one thrift against another in the possibility that the currency you have bought will soar. The dynamics of running supply and demand for foreign exchange are important, and any outstanding inequalities can negatively influence international thrift.

When conducting technical analysis, the essential techniques utilized to examine price charts are the same between crypto and forex trading. One significant distinction shines out, though: compared to FX, the volatility of the crypto markets is far higher.

About $3 trillion is the market capitalization of all cryptocurrencies. It took 12 years to create the initially combined valuations of $1 trillion and an additional 11 months to add the subsequent $2 trillion. The real value of the cryptocurrency market is rising swiftly.

Contrarily, figuring out the worth of FX is more challenging. The value of the global economy as a whole, projected to be $80 trillion in 2017, can be calculated by economists.

The Bank for International Settlements (BIS) estimates the volume of foreign exchange trade globally every three years. According to the most recent statistics BIS released in September 2019, there were $6.6 trillion in daily FX transactions, up from $5.1 trillion three years prior.

Given the decentralized nature of cryptocurrencies, it is challenging to quantify trading volumes. However, estimates range from $100 billion to $500 billion daily.

The methods and trading procedures for forex are well-established and have been in use for some time. Even though Bitcoin has been around for 13 years, it has only recently become simple to buy Bitcoin.

There were retail customers, miners, and a few small centralized exchanges in the early days of Bitcoin. Now that they have grown, these exchanges provide hundreds of coins.

Additionally, in the early days of cryptocurrency, it wasn't yet possible to retain cryptocurrency in custody on behalf of another party. Not until MicroStrategy (MSTR) revealed its first Bitcoin purchase in August 2020 did the door open for businesses looking to include cryptocurrencies into their treasury strategies.

This made it possible for more crypto "whales" to join the fray. The two main cryptocurrencies that institutions are buying up are Bitcoin and Ethereum.

As multinational corporations need to pay their employees in other nations, banks constantly exchange currencies through forex trading. They have been doing this for decades. Banks act in "yards," which are equivalent to one billion dollars in money. Smaller forex dealers have developed the technology necessary to purchase and sell currencies while mitigating their exposure to larger institutions over the past 20 years.

The evolution of cryptocurrency and forex trading differ significantly in that cryptocurrency was designed from the beginning with the small retail trader in mind, whereas FX trading was only available to big institutions. The "small guy" ultimately gained access to FX trading while bigger institutions eventually joined crypto.

You always exchange one thing for another when trading the market. For instance, if you want to buy Tesla shares, you will probably convert your US dollars into TSLA.

Because forex traders understand the swap so well, their currencies are quoted in pairs. Seven major currencies, for instance, are the focus of most trading speculation. There are 21 pairs created when you arrange the currencyies in a matrix.

You can log in to the majority of FX brokers and find a quote for the exchange rate for any of these pairs. To trade EUR/JPY, you don't even need to have any European euros or Japanese yen in your account. Trading EUR/JPY involves making predictions about the direction of the exchange rate for EUR against JPY.

Cryptocurrency is still in the early stages of acceptance. The majority of cryptocurrency pairs use Tether (USDT), Bitcoin (BTC), Ethereum (ETH), or the exchange's native coin as the quote currency, although you can easily establish your own cross rate.

Additionally, there are currently more than 10,000 cryptos accessible. Making a switch out of two reasonably little cryptos is simply too laborious. As a result, a middleman like Bitcoin, Tether, or Ethereum is employed; for instance, you first trade into Ethereum before purchasing the coin of interest.

The majority of traders in the forex market lose money, which is commonly recognized. Typically, between 25 and 35% of traders generate at least $1 extra in their accounts over a quarter, depending on the quarter. Therefore, 65-75% of traders lose money since they don't.

Leverage had a significant role in the traders' losses. Financial leverage is a tool that can amplify gains and losses. As a result, when using high levels of leverage, it only takes a small shift in the market against the trader's position to result in a margin call, which completely depletes the trader's trading account. In general, traders have adequate breathing room with less than 10 leverage to survive sudden fluctuations in pricing.

High-speed computing's arrival and the decentralized nature of both forex and cryptocurrencies provide for the possibility of arbitrage possibilities between two distinct dealers or exchanges. In arbitrage, a trader will purchase at one location and then sell thereafter determining the price difference between the two locations.

Since there are fewer price fluctuations while trading currencies, dealers may provide higher levels of liquidity. This helps explain why the daily value of FX trading is roughly $6.6 trillion, compared to the daily value of cryptocurrency trading, which is anticipated to range from $100 billion to $200 billion and reach $516 billion in May 2021. According to this, the FX market's liquidity is between 12 and 60 times bigger than the crypto markets. Both are large markets.

Large positions are simpler to enter and exit when there is more liquidity.

Trading in cryptocurrencies is fundamentally riskier than trading in currency. Consequently, a larger margin is typically needed (the more volatile the product is). As a result, forex trading often offers bigger leveraged quantities than cryptocurrency trading.

To satisfy the demands of investors and dealers around the world, both forex and cryptocurrencies are traded continuously. As a result, both kinds of exchanges have locations spread out around the globe to cater to local customers.

From Monday morning in Wellington, New Zealand until Friday afternoon in New York City, there are 24-hour forex trades taking place. Although some forex firms allow weekend trading, you typically deal directly with your broker in those circumstances.

Crypto, on the other hand, is awake constantly. Cryptocurrency trading is open every day of the week in addition to 24 hours a day. You can purchase and sell cryptocurrency through your exchange at any time of the day.

What is an Indicator?

Indicators are statistical tools for both measuring the present and predicting future financial or economic trends.

In the world of investing, indicators are most often used to describe technical chart patterns based on a security's price, volume, or open interest. Moving averages, moving average convergence divergence (MACD), relative strength index (RSI), and on-balance-volume are examples of common technical indicators (OBV).

Indicators in economics typically refer to bits of data that are used to assess the state of the economy as a whole and forecast its future course. They consist of data on the GDP, unemployment, and the Consumer Price Index (CPI).

A series of tools known as indicators are used on a trading chart to assist make the market more understandable. For instance, they can confirm if the market is trending or range.

Additionally, indicators can provide specific market data, such as when an item is overbought or oversold relative to its price range and is therefore due for a reversal.

There are two ways to display indicators:

- Below the price chart, in a different space, for example, the stochastic and MACD

- Directly on the price chart, such as Bollinger brands, moving averages, or channels

An indicator is a mathematical calculation used in technical analysis that is based on the price or volume of security. Future price predictions are made using the outcome.

There are many various sorts of indicators, but it's critical to first recognize that they can be divided into two groups:

Lagging: Providing signs that validate the price action's behavior.

Leading: Providing signals before the price action occurs.

Leading indicators track the rate of change in price movement and can detect when it is accelerating or decelerating. An asset may be due for a reversal, for instance, if the price action has risen quickly before slowing down. This momentum change can be detected by a leading indicator.

The majority of the time, a trailing indicator is utilized to validate what the price action has done, such as if it has entered into a trend and the strength of that trend. Because they lag behind price activity, they are known as lagging indicators.

Depending on how it calculates the price action to offer the signal, each indicator generates trading signals in a unique way. They can also be divided into two groups:

- Trending indicators that perform well in markets that are trending

- The finest oscillating/ranging indicators for ranging markets

A trending indicator can help make the direction and strength of a trend on a chart more visible. The nature of trending indicators is typically lagging. The strength of a trend can be determined using trending indicators, which are also used to help traders enter and exit the market. Trending indicators have a tendency to lag in nature.

Therefore, using trending indicators can help a trader: - Determine whether the market is trending; - Determine the intensity and direction of that trend; - Aid in locating entrances and exits into and out of the market.

An oscillating indicator, which indicates whether something is overbought or oversold, assists in identifying the upper and lower limits of a range when the price is moving within it. They achieve this by bouncing back and forth between higher and lower levels. Leading indicators are more common in oscillating indicators.

Indicators that oscillate are used to determine whether an asset is overbought or oversold. They typically have a leading nature.

A trader is likely to hunt for other opportunities if an oscillating indicator suggests that an instrument is overbought.

Likely, a trader will search for long positions if an oscillating indicator indicates that an instrument is oversold.

The trading system and the trader's preferences ultimately determine the type of indicators that are employed.

It is up to the trader to choose the sort of indication they want to employ, although oscillating indicators are helpful in range markets while trending indicators are helpful in trending markets.

For instance, oscillating indicators like the stochastic, commodities channel index, or relative strength index will be helpful to aid in trading decisions if you want to trade in range markets.

Trending indicators, such as the MACD or average directional index, will be more useful if you choose to trade in a market that is trending.

It is advantageous to combine trending and oscillating indicators for use in various market circumstances. You can employ each indication in accordance with its strength because market circumstances are always changing from ranging to trending and back again.

The relative strength index (RSI) and the moving average convergence-divergence (MACD) indicator are popular technical analysis indicators (RSI).

The MACD is predicated on the idea that the price of a traded asset has a propensity to return to a trend line.

The RSI calculates the asset's price movement, either up or down, by comparing the size of recent gains to recent losses. Technical traders examine asset price charts using instruments like the MACD and RSI in search of patterns that will suggest when to purchase or sell the asset in question.

Technical indicators, which are utilized by traders who follow technical analysis, are heuristic or pattern-based indications generated by the price, volume, and/or open interest of an asset or contract.

Technical analysts utilize indicators to forecast future price changes by examining historical data. The Relative Strength Index (RSI), Money Flow Index (MFI), stochastics, moving average convergence divergence (MACD), and Bollinger Bands are a few examples of popular technical indicators.

By examining statistical trends gleaned from trading activity, such as price movement and volume, technical analysis is a trading discipline used to assess investments and spot trading opportunities.

Technical analysts concentrate on price movement patterns, trading signals, and many other analytical charting tools to assess a security's strength or weakness, in contrast to fundamental analysts who attempt to determine a security's underlying value based on financial or economic facts.

Any security with previous trading data can be used for technical analysis. Stocks, futures, commodities, fixed-income, currencies, and other assets are included in this. Throughout this class, we'll often study stocks as our examples, but you can use these ideas with any kind of security. Technical analysis is actually much more common in the commodities and currency markets, where traders pay attention to short-term price changes.

Technical indicators, also referred to as "technicals," are more concerned with historical trading data than business fundamentals like earnings, revenue, or profit margins. These data include price, volume, and open interest. Since technical indicators are made to examine short-term price changes, active traders frequently utilize them, but long-term investors can also use them to find profitable entry and exit opportunities.

When assessing securities, traders frequently employ a wide range of technical indicators. Traders must select the indicators that perform best for them and become familiar with how they operate out of the thousands of possibilities available. To generate trade ideas, traders may also combine technical indicators with less objective types of technical research, like examining chart patterns. Given their quantitative nature, technical indicators can also be included in automated trading systems.

What are Crypto Signals?

Crypto signals are alerts sent out by analysts with advice on which coin to purchase or sell at what time.

Trading signals for cryptocurrencies are based on technical analysis carried out by skilled and experienced traders. Although the bitcoin market is dynamic, the signals are triggered with high precision.

Crypto signals are recommendations from professional traders to purchase or sell a particular cryptocurrency at a particular rate or moment. The present state of the market, technical analysis, and news can all be used to produce trade signals for cryptocurrencies.

You can swiftly and successfully decide whether to complete a certain transaction using crypto signals. The following details are included in the crypto signal:

- The name of the cryptocurrency you should buy or sell, as well as its price

- When to sell in order to maximize profit

- Stop Loss - This is the trade's stop loss, which lets you know when to close the position.

Signals are trading suggestions used to follow and analyze a specific currency. The best time to buy or sell is indicated by crypto trading signals. Therefore, the key to better trading in the cryptocurrency market is selecting one of the finest signal providers.

A technical indicator-based trading notion with time and price significance that is based on examination of the current and/or previous market environment and is used in cryptocurrency trading.

There are two types of crypto signals available on the market: standard crypto signals derived from technical analysis and crypto pump signals that prepare consumers to pump one or more crypto coins. You have the chance to trade using cryptocurrency signals and make big profits while learning about the market.

In exchange for a monetary subscription to their platform, an expert trader or group of traders provides the entry and exit points of a market opportunity. Some websites offer free cryptocurrency trading signals. Others provide information that you can use to identify the signals on your own.

Buying or selling bitcoin at a specific price or time is suggested by professionals using both automated and manual crypto signals. They frequently draw inspiration from a variety of sources, including news, technical analysis, and current market movements.

Essentially, cryptocurrency signals are a collection of directives or suggestions that traders use to decide on buying or selling cryptocurrencies. These signals could be founded on news, technical analysis, or other elements. Cryptocurrency signals can be produced by algorithms or by people.

There are two methods for creating crypto trading signals: manually and automatically. Signals for automated cryptocurrency trading are generated by trading software that was developed by qualified professionals and programmers. They use several specialized indicators to examine historical data on the movement of currency pair prices and identify trends, which they subsequently communicate as trading recommendations.

Expert traders and analysts who supervise market investigations to identify trading opportunities produce reports that serve as the basis for manual crypto trading signals. They then identify the entry and exit levels of the trading suggestions they discover using specific indicators on the charts. Unlike automated market signals, manual signals are controlled by human thought and emotion. They use fundamental analysis to match news and market sentiment to find profitable trading ideas.

With the help of crypto trading signals, you may trade and make large gains while learning about the cryptocurrency market. An expert trader or group of traders offers entry and exit points for a market opportunity in return for a fee to use their platform.

Targeted sale prices are the various price tiers that traders should set as targets or "take profit" zones. This often offers customers a variety of options to increase their possible profits while lowering their risk of suffering a loss if the intended sell price is not met.

A crypto signal includes a simple action, the cryptocurrency's name, price, and sometimes even a specific exchange that is worthwhile using.

Buy bitcoin, for instance, at $33,500. Or sell the coin when its price falls to a certain level, such as $32,500. The mailbox receives the majority of the signals. Another thing to be aware of is the fact that some crypto signals favor Telegram as their preferred medium for delivery.

Crypto trading signal systems are used by cryptocurrency traders all over the world to assist them in making risky selections. They are among the most effective and trustworthy tools for doing profitable crypto trading.

In one way or another, all seasoned traders suggest using them. There are many different kinds of cryptocurrency trading signals, some of which are available for free and some of which require payment. However, a reliable service must provide details on how to set stop-loss and take-profit levels.

There are two methods for creating crypto trading signals: manually and automatically. Signals for automated cryptocurrency trading are generated by trading software that was developed by qualified professionals and programmers. They use a number of specialized indicators to examine historical data on the movement of currency pair prices and identify trends, which they subsequently communicate as trading recommendations.

Expert traders and analysts who supervise market investigations to identify trading opportunities produce reports that serve as the basis for manual crypto trading signals.

They then identify the entry and exit levels of the trading suggestions they discover using specific indicators on the charts. Unlike automated market signals, manual signals are controlled by human thought and emotion. They use fundamental analysis to match news and market sentiment to find profitable trading ideas.

Because manual signals typically support larger transactions with profit-taking targets and, as a result, may provide stronger risk-to-reward rates in their instructions, they differ from automated signals. Since manual signals are posted by people, they are also considerably more adaptable to sudden market swings and volatility because signal providers can raise profit targets on profitable trades or manually close contracts. that defies the first advice and presents a chance for greater profits and smaller losses.

Automatic cryptocurrency trading signals, on the other hand, remove the human aspect from trading and offer assistance without any emotional attachment, which can occasionally be effective in the field of crypto trading. They are additionally back-tested to increase user confidence in their systems.

How to Get Singnals and Tools?

According to what is said, you need signals for trading and the below list is a guidance for different signals that you can get, different tools for providing a reliable signal and everything that you may need:

- Crypto Singal Leaks

- Crypto VIP Signals

- Crypto Signal

- Future Signal

- Indicator Crypto

- Binance Spot Trading Signals

- Binance Futures Signals

- VIP Crypto Signal Telegram

- Leaked Crypto Signals Group

Best Indicators for Crypto Day Trading

MACD

The MACD formula is employed to show trend-following momentum. This is the way to calculate it:

26 period EMA (Exponential Moving Average) – 12 period EMA (at closing prices)

Upward momentum is appropriately indicated if the MACD is positive. A bullish cross occurs when the MACD slopes higher toward crossing the signal line (as seen below), and it can be used to determine whether it is a good time to buy. When the MACD is negative, there is a downward momentum. A bearish cross occurs when the MACD slopes downward, crosses the signal line, and moves below it; this might be regarded as a good moment to sell.

The MACD is a trend-following indicator that evaluates if the short-term price momentum is keeping up with the long-term price momentum, and if not, it is used to predict whether a trend change is imminent. There are four parts to the MACD: the MACD line, signal line, zero line, and histogram.

Subtract the 26-EMA from the 12-EMA to create the MACD line. To increase sensitivity to trend changes and price momentum, EMAs are utilized in place of MAs.

Many trading signals are based on the combination of the signal line and the MACD line as they converge, diverge, and cross.

When the zero line is achieved, the MACD line is at zero. This level is where the 26- and 12-period EMAs are.

The MACD histogram shows how far away from the signal line the MACD line is. It can be either positive or negative depending on whether the MACD line is above the signal line.

Because it lacks a definite range, the MACD differs from other Bitcoin indicators; thus, it's not appropriate for determining oversold and overbought situations.

The following are some of the common MACD trading indications that can be generated when two oscillating lines cross:

When the MACD crosses over the signal line, it is bullish.

When the MACD line passes the signal line, the situation is bearish.

These crossovers happen frequently, so you can get a lot of false positives.

As a result, it's better to combine these signals with others to improve your results than to rely only on them to inform trading decisions.

A bullish signal, denoting an increase in positive momentum, is produced when the MACD line and signal line both rise at the same time. But if MACD is declining, this is a bearish indication that emphasizes growing negative momentum.

You can use MACD to identify price divergence to get a trading signal. A bearish divergence occurs when the price makes a higher low while the MACD makes a lower low, or when the price makes a lower low while the MACD makes a higher high.

When the price makes a higher high while the MACD makes a lower high or when the price makes a lower high while the MACD makes a higher high, this is known as a bearish divergence.

When the price is lower low and the MACD makes a higher low, an uptrend change is about to occur.

MYC Trading Indicator

The MYC Trading Indicator is a secret indicator that uses momentum oscillators and trend analysis to precisely predict when a cryptocurrency will begin a bullish or bearish trend.

A key component of the indicator is the trendline, which indicates whether a long signal will be generated when the price increases and whether a short signal will be generated when the price falls.

Unlike the RSI or Bollinger Bands, MYC offers traders not only a proposed entry point but also a recommended exit point.

RSI

Technical analyst Welles Wilder created the Relative Strength Index, which enables traders to benefit before the market self-corrects by letting them know when the price of Bitcoin is too far from its "true" value.

The Relative Strength Index is used by traders to find great entry points for trades, and research has shown that it can be a very useful tool for trading volatile cryptocurrency markets.

Through recent price fluctuations, RSI is used to identify an asset's strength or weakness, from which it is possible to determine if an item has been overbought or oversold. How to compute it is as follows:

RSI = 100 – 100 / (1 + RS) RS = Average of periods that close up in price / Average of periods which go down in price Normally the number of periods used is 14, but it is entirely up to the trader how many to use.

Generally speaking, if the value is less than 30, the item has likely been oversold. On the other hand, if the value is greater than 70, the asset has likely been overbought.

The RSI indicator is typically used by traders to identify overbought and oversold market conditions, in which the price of the asset may move too quickly or reverse. To identify divergence between the two, traders compare the RSI swings with the asset's price movements. The latter is yet another indication that the asset's present price movement may change course.

The direction of the price might quickly alter in short-term trading. The RSI and other momentum indicators for day trading are leading indicators, which means that they may change direction before prices do. It provides traders with a signal that it's time to leave the trade before the asset's price reverses.

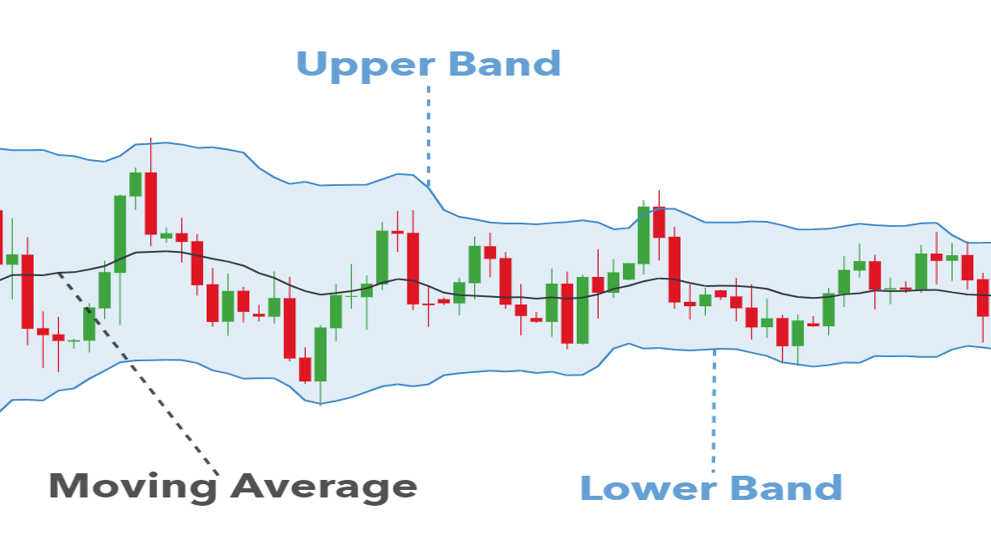

Bollinger Bands

A well-known type of technical analysis indicator called Bollinger Bands was developed in the 1980s by financial expert John Bollinger. They serve as an oscillator that gauge's market volatility and are employed by traders for technical analysis.

This Bitcoin indicator's main goal is to show how prices vary from the usual value.

Bollinger Bands are intended to display the difference between a market's high and low extremes using their upper band, moving average line, and lower band. The two external brands depict changes in market pricing.

They expand by migrating away from the center band when volatility is high. They contract by shifting closer to the center band when volatility is low.

A 20-day simple moving average (SMA) is used to establish the centerline for the Bollinger Bands. Like the upper and lower bands, the top and bottom bands are influenced by market volatility.

The Bollinger Bands indicator uses the widths of the upper and lower bands in conjunction with price changes to predict how an asset's price will move inside a band. A price reversal could be on the horizon if you observe the price of an item moving outside of the upper and lower ranges. This interpretation is possible:

Middle Band – Simple Moving Average over 20 days (SMA)

Upper Band – SMA over 20 days + (Standard deviation of price over 20 days x 2)

Lower Band – SMA over 20 days – (Standard deviation of price over 20 days x 2)

OBV

An indicator called OBV makes use of an asset's volume flow to forecast price movements and assess how strong buy or sell signals are. The volume for that day is added to the OBV's total if an asset's price closes higher because it is utilized as a cumulative indication. However, the volume for that day is subtracted from the OBV's total if an asset's price closes down. No computations are done if it is the same.

The idea is actually fairly straightforward: if the high is higher (barring a resistance zone), this indicates positive volume pressure and increases the likelihood that the price will rise. A lower height has the opposite effect, unless it (hits a support zone. This denotes negative volume pressure and a high probability that an asset's price will drop.

SuperTrend

An indicator that resembles moving averages is the SuperTrend. Its location may influence how much it costs. One of the simplest day trading indicators is based on the period and the multiplier.

The multiplier is set to three when creating the SuperTrend indicator, which uses the Average True Range (ATR) with a default parameter of 10. The SuperTrend calculates its value and signals the level of price volatility using the Average True Range indicator.

Use the chart of the stock you want to see and set the time interval to 10 minutes to examine the SuperTrend for intraday trading. Use any reliable charting program and your own settings to check the indication.

You shouldn't avoid using the Stop-Loss when using SuperTrend. For a long position, place it at the green indicator line; for a short position, place it at the red indicator line. The greatest way to increase your trading profits is to use the SuperTrend indicator and Stop-Loss patterns.

You can see that when the SuperTrend indicator is positioned below the bars, an upward trend is revealed. When positioned over the bars, the trend is downward. The signal to buy appears when the color turns green. When the SuperTrend turns red and closes above the price, you get a sell signal.

On-Balance Volume

On-Balance Volume displays the volume's history. It also discloses how many stocks were acquired and sold over time. The indicator displays the strength of any fluctuations in the stock price. One of the most important volume indicators for day trading is on-balance volume.

The On-Balance Volume (OBV) indicator examines the total trading volume for the asset over a predetermined period of time. The indicator takes the trade volume over the last few days, weeks, and months into account. Simply put, it gauges the buying and selling pressure of the coin or stock.

The following three principles are used to determine OBV:

If today's price of the stock/coin is higher than yesterday's closing price:

Current OBV = Yesterday’s OBV + Today's trading volume

If today's price of the stock/coin is lower than yesterday's closing price:

Current OBV = Yesterday's OBV - Today's trading volume

If today's price of the stock/coin is equal to yesterday's indicators:

Yesterday's OBV = Today's OBV

The OBV interpretation commonly sounds like this:

A growing OBV is a sign that the price is on the upward. It indicates that more buyers are willing to pay the market price for the asset.

High selling pressure is indicated by a declining OBV. As traders sell to book profits, it typically seems close to record highs.

When volume reinforces price movement, the trend is in the desired direction. The indicator represents market confusion if price movement is incongruent with OBV movement.

The OBV indicator is useful for day trading. It's not advised to completely rely on it when making day trading decisions, though.

Accumulation/Distribution Line

A common volume-based indicator known as the Accumulation/Distribution Line (A/D Line) is used to determine the trend direction of a stock or coin based on the link between trading volume and price. The A/D line indicator determines whether a stock or currency is being accumulated or distributed, with distribution denoting an asset's selling levels and accumulation denoting its buying levels.

The A/D line can be calculated using two measurements. These are the Money Flow Volume and the Money Flow Multiplier (MFM) (MFV).

Add the Previous A/D Line value to the MFC for the Current Period to create the A/D line. The A/D line is continued by adding the current A/D value to the MFC of the following day because it runs total.

One of the strongest indicators for day trading is the A/D line. Use it to support the current trend and monitor the pressure to purchase and sell. However, using the A/D line as a sole indicator to guide your day trading selections is not advisable. When combined with other technical elements, it can help traders get significantly better results.

Average Directional Index

The direction or trend of the coin or stock is used as the primary technical indicator by the Average Directional Index (ADX) indicator. The positive directional indicator (+DI) is observed when the trend is moving higher. The -DI negative directional indicator will be present when the trend is moving downward.

The coin or stock's current trend's strength is gauged by ADX. The indicator can be used by traders and investors to make predictions about whether to short or long a particular asset.

You must divide the period into 14 bars in order to determine the ADX. The indicator can be used to both shorter (7 bars) and longer (14 bars) timelines. Longer bars are more time-consuming but less dependable for day trading, whereas shorter bars make the ADX too erratic.

Aroon Indicator

One of the best indicators for day trading is the Aroon Indicator. The Aroon indicator, like ADX, enables traders to identify trends and assess their strength. The Aroon Indicator consists of two Aroon lines. These are measured on a scale from 0 to 100 and are known as the AroonUp line and AroonDown line, respectively.

By counting the days since the asset's price hit the 25-day high, the AroonUp Line evaluates the asset's uptrend. It denotes that the asset's AroonUp value is 100 if it maintains its 25-day high. The trend of the asset is weaker the lower the AroonUp indicator drops.

After that, let's examine the Aroon Indicator's interpretation:

The asset is anticipated to increase in value if the AroonUp line's value falls between 70 and 100 and the AroonDown line's value falls between 0 and 30.

The asset will continue to see consistent price declines if the value of the AroonUp line falls between 0 and 30 while the value of the AroonDown line increases.

The asset consolidates at a particular price point if the values of the AroonUp and AroonDown lines are equal.

Stochastic Oscillator

One of the strongest indicators for daily trading crypto is the stochastic oscillator. The indicator contrasts the closing price of the stock with a range of prices over a specified period of time. The Stochastic Oscillator was created to track price movement quickly.

The indicator swings between 0 and 100 in order to represent the momentum of an item. You can choose the 14-period, which might be 14 days, weeks, or months, depending on the analysis's objective.

The formula below is used to calculate the stochastic oscillator:

%K = (Current Close - Lowest Low)/(Highest High - Lowest Low) * 100

%D = 3-day SMA of %K — This acts as a Signal/Trigger Line

Where the Highest High is the highest high for the time period and the Lowest Low is the lowest low for the time period.

The stock's or coin's current price is getting close to its low for the selected timeframe if the Stochastic Oscillator readings are below 20.

The stock's or coin's current price is approaching the highest price during the selected timeframe if the Stochastic Oscillator readings are over 80.

Despite being one of the strongest technical indicators for day trading, it is not suggested to utilize the stochastic oscillator as the only indicator when developing a comprehensive trading strategy.

Moving Averages (MA)

In the Bitcoin market, a moving average indicator is a type of smoothing. Since the moving average (MA) is a lagging indicator, it considers price changes from earlier days.

In order to identify trends and forecast price changes, we use the moving average.

Moving averages come in two varieties: basic and exponential.

Your trading style will determine the MA you select; if you are a short-term trader, for example, a shorter MA will be more advantageous to you. Moving averages serve as market supports and barriers.

MACD and its variations are the two most widely used trend indicators. For MAs, defining trends is simple because they can help us discover trends.

When the MA slopes higher, it suggests that the asset's price is increasing. On the other hand, if the MA slopes downward, it means the item you're looking at is losing value.

Final Thoughts of Indicators

To assess the market and predict how the price of bitcoin will change, indicators are utilized. Indicators are tools that help cryptocurrency traders more accurately predict changes in the price of their assets by utilizing technical analysis.

In order to help traders, make decisions, the data from the formulas is then plotted on a graph and shown next to or overlaid on a trading chart.

This article's goal was to acquaint you with the best day trading indicators and how to use them most effectively. Before using any trading indicators, it's important to understand how they might be interpreted and what they can and cannot do. You can become a profitable trader by combining this information with your risk tolerance.

Comments