The Lindy Effect and Its Implications on Bitcoin: A Timeless Crypto Phenomenon

In the world of cryptocurrency, few phenomena have captured the attention of enthusiasts, investors, and researchers alike as profoundly as the Lindy Effect's impact on Bitcoin. The Lindy Effect, popularized by Nassim Nicholas Taleb, is a concept that suggests the longer a non-perishable entity, like an idea or technology, survives, the longer it is expected to endure into the future. In this article, we will delve into the Lindy Effect's application to Bitcoin and explore its significance in shaping the crypto's future over the last few decades.

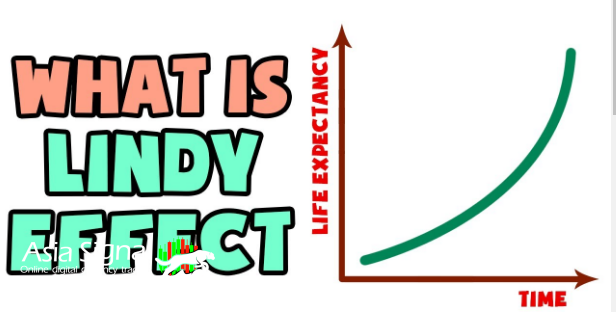

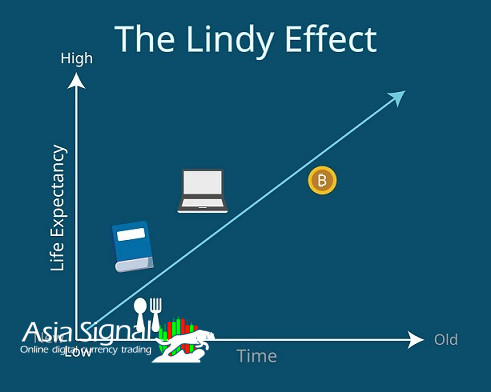

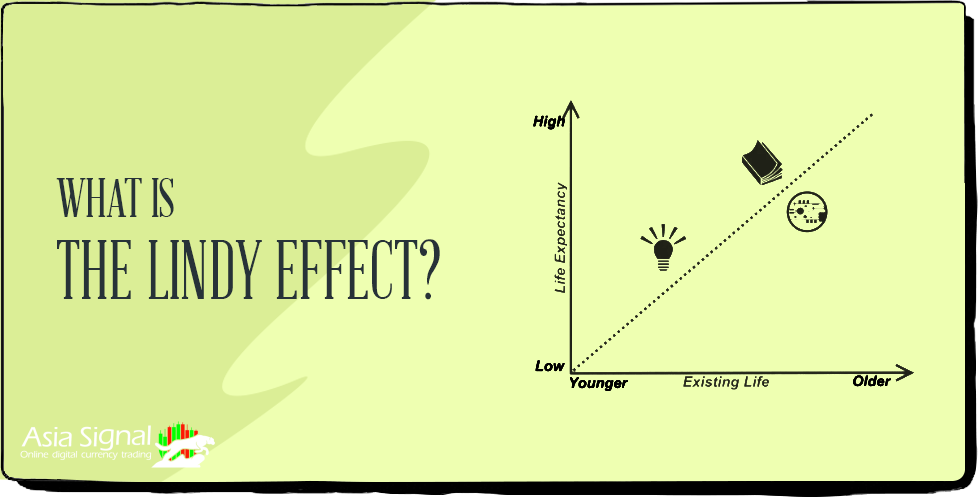

1. Understanding the Lindy Effect

The Lindy Effect finds its roots in the restaurant culture of New York City, where it was used as a heuristic to predict the continued survival of restaurants based on their age. The fundamental idea is that for any non-perishable entity, the probability of its future existence increases with its age. This principle can be applied to various domains, including technology and ideas.

According to Taleb, the Lindy Effect is a compelling concept for understanding the longevity and robustness of cultural artifacts, innovations, and inventions. It suggests that the longer something has existed, the more likely it is to continue thriving in the future.

2. Bitcoin's Emergence and Early Days

Bitcoin, the world's first cryptocurrency, emerged in 2009 when an anonymous individual or group of people, under the pseudonym Satoshi Nakamoto, published the Bitcoin whitepaper. The paper outlined a decentralized peer-to-peer electronic cash system, providing an alternative to traditional financial systems controlled by centralized authorities.

During its early days, Bitcoin faced numerous challenges, including skepticism from traditional financial institutions and regulatory authorities. However, the concept of a digital currency operating on a decentralized blockchain network struck a chord with many early adopters, leading to a steady increase in its adoption and use.

3. The Lindy Effect and Bitcoin's Resilience

As Bitcoin survived and thrived through its first few years, it became increasingly apparent that the Lindy Effect was at play. The longer Bitcoin remained in existence, the more confidence it instilled in the minds of its users and the broader community. As its resilience grew, so did its credibility as a viable form of digital money.

The Lindy Effect has played a significant role in sustaining Bitcoin during times of adversity. Market crashes, regulatory challenges, and technological hurdles have tested the cryptocurrency's resolve. However, due to the Lindy Effect, each time Bitcoin successfully navigated these challenges, it further solidified its position as the pioneering cryptocurrency.

4. Adoption and Network Effects

As the Lindy Effect continued to bolster Bitcoin's survival, another powerful phenomenon came into play - the network effect. The network effect occurs when the value of a product or service increases as more people use it. In the case of Bitcoin, as more individuals and institutions adopted it, the network effect amplified its utility and appeal.

Bitcoin's early adopters played a crucial role in spreading awareness and advocating for its benefits. As the number of users increased, so did the number of use cases and applications for Bitcoin. Merchants started accepting it as a means of payment, and financial products and services catering to Bitcoin users began to emerge.

5. The Lindy Effect and Technological Development

As Bitcoin continued to mature, technological advancements were made to address some of its limitations, such as scalability and transaction speed. The development of the Lightning Network, a second-layer solution built on top of the Bitcoin blockchain, aimed to improve transaction throughput and reduce fees.

Interestingly, the Lindy Effect also influenced the development and upgrade process of Bitcoin. Developers, guided by the principle of preserving the core principles of the original whitepaper, were cautious about introducing changes that could compromise the cryptocurrency's integrity. This cautious approach, based on the Lindy Effect, has helped maintain Bitcoin's stability and security over time.

6. Lindy Effect and the Altcoin Market

While Bitcoin remained the dominant cryptocurrency, a host of alternative cryptocurrencies, or altcoins, emerged to challenge its supremacy. Many altcoins promised faster transaction times, enhanced privacy, or novel consensus mechanisms.

However, the Lindy Effect played a crucial role in distinguishing Bitcoin from most of these altcoins. The longer an altcoin existed, the more likely it was to fade away due to the network effect favoring Bitcoin. Altcoins often struggled to achieve the same level of recognition, adoption, and trust that Bitcoin had amassed over its decade-long existence.

7. Investor Sentiment and the Lindy Effect

Investor sentiment plays a vital role in the cryptocurrency market, influencing the price and volatility of digital assets. The Lindy Effect can significantly impact investor behavior, especially in the context of Bitcoin's historical performance.

As Bitcoin's age increases, the Lindy Effect strengthens investor confidence, leading to a more stable and mature market. This, in turn, reduces the impact of short-term market fluctuations and speculative behaviors, promoting a more sustainable investment environment.

8. Institutional Adoption and the Lindy Effect

In recent years, Bitcoin has witnessed an influx of institutional interest and investment. Institutional players, including hedge funds, asset managers, and corporations, have recognized the potential of Bitcoin as a store of value and a hedge against traditional financial risks.

The Lindy Effect has played a role in institutional adoption as well. The longer Bitcoin survived, the more credibility it garnered, making it a more attractive investment option for conservative institutions seeking to diversify their portfolios.

9. Challenges to the Lindy Effect and Bitcoin

While the Lindy Effect has been a powerful force in shaping Bitcoin's journey thus far, it is not without its critics and challenges. One of the primary critiques revolves around technological stagnation. Some argue that Bitcoin's adherence to its original principles, while preserving security and stability, may hinder its ability to adapt and innovate.

Furthermore, new technological advancements, such as quantum computing, may pose threats to Bitcoin's underlying cryptography. While these challenges are legitimate, the Lindy Effect's enduring power suggests that Bitcoin will continue to adapt and evolve as needed to remain relevant and secure in the face of technological advancements.

10. Conclusion

The Lindy Effect's impact on Bitcoin cannot be understated. Over the course of its existence, the cryptocurrency has demonstrated resilience, adaptability, and growing investor confidence, all of which have been influenced by the Lindy Effect. As the cryptocurrency ecosystem continues to evolve, the Lindy Effect is likely to remain a key factor in shaping Bitcoin's path into the future. By studying and understanding this powerful phenomenon, we gain valuable insights into the long-term prospects of Bitcoin and its role in the broader financial landscape.

The latest Forex, digital currency and futures signals in Asia Signal

Comments