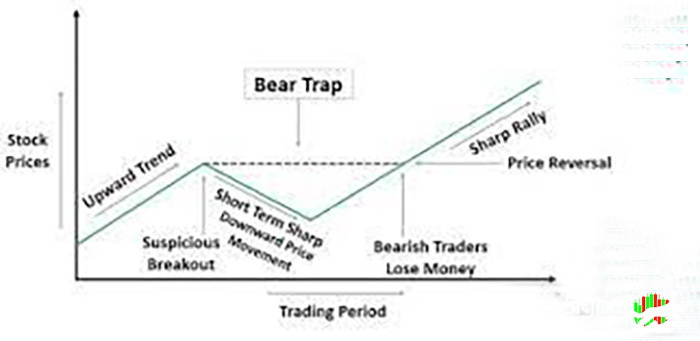

The term "bear trap" typically refers to a situation in financial markets, particularly in the context of stock trading or investing. It is a metaphorical term used to describe a scenario where investors or traders are lured into selling their stocks or assets because they believe the market is going to decline further (a bearish outlook), only to find out that the market actually reverses and starts to rise again.

In other words, a bear trap occurs when there is a temporary decline or downturn in the market that convinces investors that the price of a particular asset or the market as a whole will continue to drop. As a result, they may sell their positions to avoid further losses or to take advantage of what they perceive as an opportunity to buy back at lower prices. However, instead of continuing to decline, the market reverses direction and starts to rise, catching those who sold off guard and potentially leading to missed opportunities or losses for the sellers.

The term "bear trap" is derived from the concept of a bear market, which refers to a prolonged period of declining stock prices and overall pessimism in the market. A bear trap is essentially a false signal or temporary reversal within a bear market that leads investors to make the wrong trading decisions.

It's worth noting that the term "bear trap" can also be used in other contexts outside of finance, where it generally refers to a situation where someone is deceived or tricked into a disadvantageous position.

Understanding Bear Traps

A Guide to Avoiding Financial Pitfalls Bear traps can be a significant challenge for investors and traders alike, as they can lead to costly mistakes and missed opportunities. Understanding the dynamics of bear traps is essential for navigating the complex world of finance. A bear trap occurs when a temporary decline in the market convinces participants that prices will continue to fall. This pessimistic sentiment prompts investors to sell their assets, only to find that the market reverses and starts to rise again, leaving them in a disadvantageous position.

To avoid falling into a bear trap, it is crucial to conduct thorough market analysis and rely on reliable indicators. Technical analysis tools, such as trend lines, moving averages, and momentum oscillators, can provide insights into market trends and potential reversals. Additionally, keeping emotions in check and avoiding impulsive decision-making is essential. Developing a well-defined investment strategy and sticking to it can help investors resist the temptation of selling during a bear trap.

Decoding the Bear Trap Phenomenon

What Every Investor Should Know Deciphering the bear trap phenomenon is vital for investors seeking to make informed decisions in volatile markets. Recognizing the patterns and characteristics of bear traps can help investors avoid being misled and potentially capitalize on favorable market conditions. One common trait of bear traps is the rapid decline in prices, which often triggers panic selling among investors. This panic creates an illusion of an impending bear market, leading to further selling and reinforcing the trap.

Investors should be cautious when evaluating market sentiment during a potential bear trap. Overly pessimistic news or excessive negativity can contribute to the trap, as fear and uncertainty drive investor behavior. By conducting comprehensive research, analyzing historical data, and staying informed about market fundamentals, investors can gain a more accurate perspective and make rational decisions. Being aware of the psychological aspects of market behavior is also essential, as fear and greed can significantly influence investor sentiment during bear traps.

Navigating Bear Traps in Stock Markets

Recognizing False Signals Successfully navigating bear traps in stock markets requires the ability to distinguish false signals from genuine market trends. False signals are often characterized by short-term price fluctuations that temporarily deviate from the overall market direction. These fluctuations can mislead investors into making hasty decisions, potentially leading to losses or missed opportunities. Therefore, it is crucial to develop a discerning eye and employ analytical tools to separate noise from actual market movements.

One effective strategy for recognizing false signals is to analyze multiple indicators and data points. By considering a variety of technical indicators, such as moving averages, volume patterns, and support and resistance levels, investors can obtain a more comprehensive view of the market. Additionally, paying attention to market breadth, which measures the participation of various stocks in a market move, can help identify whether a bear trap is more likely to be genuine or a temporary fluctuation affecting only a few stocks.

Risk management is another critical aspect of navigating bear traps. Setting stop-loss orders and maintaining a diversified portfolio can help protect against potential losses. By establishing clear entry and exit points based on predetermined criteria, investors can reduce the impact of false signals and make more disciplined trading decisions. It is important to remember that even with careful analysis, bear traps can still occur, highlighting the need for resilience and adaptability in navigating volatile stock markets.

The Psychology of Bear Traps: How Emotions Influence Investment Decisions

The psychology of bear traps delves into the crucial role that emotions play in influencing investment decisions. Fear, greed, and herd mentality can drive investors to make impulsive choices, particularly during bearish market conditions. Understanding these emotional drivers is essential for investors to avoid falling into bear traps. Fear can lead to panic selling, while greed can cause investors to hold on to losing positions for too long. By recognizing the psychological biases that can cloud judgment, investors can take a more rational and disciplined approach, making informed decisions based on thorough analysis and long-term goals.

Capitalizing on Bear Traps: Turning Market Reversals into Opportunities

Capitalizing on bear traps involves a mindset shift that views market reversals as opportunities rather than threats. When a bear trap occurs and the market unexpectedly reverses, astute investors can identify potential buying opportunities at lower prices. By conducting diligent research, identifying undervalued assets, and maintaining a long-term investment horizon, investors can take advantage of these market reversals. Patience and a contrarian approach are often key to capitalizing on bear traps, as it requires resisting the temptation to follow the herd and instead focusing on long-term value.

Spotting Bear Traps: Indicators and Strategies for Market Analysis

Spotting bear traps requires a comprehensive understanding of market indicators and effective analysis strategies. Technical indicators, such as moving averages, trend lines, and oscillators, can provide valuable insights into market trends and potential reversals. Fundamental analysis, which examines a company's financial health, competitive landscape, and industry dynamics, can also help identify bearish or bullish signals. Combining these approaches with an assessment of market sentiment, economic indicators, and company-specific news can enhance the ability to spot bear traps. Developing a systematic approach to market analysis and utilizing a range of indicators and strategies can significantly improve the accuracy of identifying bear traps and making informed investment decisions.

Learning from Bear Traps: Lessons in Risk Management and Patience

Bear traps offer valuable lessons in risk management and the importance of patience in investing. They serve as reminders that markets can be unpredictable and that knee-jerk reactions based on short-term movements can lead to detrimental outcomes. By maintaining a diversified portfolio, setting clear risk management strategies, and having a long-term perspective, investors can mitigate the impact of bear traps. Learning from bear traps also emphasizes the significance of discipline and not letting emotions drive investment decisions. Patience is essential when waiting for opportunities to arise, and understanding that market cycles include both ups and downs can help investors stay focused on their long-term goals.

Avoiding the Bear Trap: Building a Resilient Investment Portfolio

Avoiding the bear trap involves building a resilient investment portfolio that can withstand market downturns. Diversification across different asset classes, sectors, and geographic regions is a fundamental strategy to reduce exposure to specific market movements. By spreading investments across a range of assets, investors can minimize the impact of bear traps on their overall portfolio. Additionally, conducting thorough research, analyzing market trends, and having a disciplined investment approach can help avoid reactive decision-making during periods of market volatility. Regularly reviewing and adjusting the portfolio based on changing market conditions is also crucial in building resilience and avoiding the bear trap.

Surviving Bear Traps: Tips for Resisting Panic Selling

Surviving bear traps requires the ability to resist panic selling, which is often driven by fear and emotional reactions to short-term market movements. One effective tip is to establish a well-defined investment plan with clear goals and risk tolerance levels. By setting predetermined exit points and stop-loss orders, investors can avoid making hasty decisions based on market fluctuations. Additionally, staying informed about the underlying fundamentals of investments, rather than solely relying on short-term market movements, can provide a more accurate perspective and help resist panic selling. Seeking advice from experienced professionals or financial advisors can also provide guidance and reassurance during turbulent market conditions.

Unveiling the Mechanics of Bear Traps: Market Dynamics and Patterns

Unveiling the mechanics of bear traps involves understanding the underlying market dynamics and patterns that contribute to these deceptive scenarios. Bear traps often occur within the broader context of a bear market, characterized by prolonged declines in stock prices and negative sentiment. By studying historical market data, patterns, and trends, investors can gain insights into the behavior of bear traps. Examining factors such as market cycles, investor sentiment, macroeconomic indicators, and company-specific news can help unravel the mechanics of bear traps and enhance the ability to anticipate and react to potential reversals. Understanding these market dynamics can provide a more comprehensive perspective and assist in making informed investment decisions.

conclusion

In conclusion, understanding bear traps is essential for investors seeking to navigate the complexities of financial markets. Bear traps, which involve deceptive market reversals that catch investors off guard, can lead to missed opportunities and financial losses. However, by delving into the psychology of bear traps and recognizing how emotions influence investment decisions, investors can take a more rational and disciplined approach to mitigate the risks.

Capitalizing on bear traps requires a shift in mindset, viewing market reversals as opportunities rather than threats. By utilizing indicators and analysis strategies, investors can spot potential bear traps and make informed decisions. Learning from bear traps emphasizes the importance of risk management, patience, and building a resilient investment portfolio that can withstand market downturns.

To survive bear traps, it is crucial to resist panic selling, set clear investment goals, and establish predetermined exit points. Additionally, understanding the underlying market dynamics and patterns contributes to unveiling the mechanics of bear traps, allowing investors to anticipate and react to potential reversals.

In the ever-changing landscape of financial markets, the knowledge and strategies discussed above can provide investors with a solid foundation to navigate bear traps successfully. By staying informed, adopting a disciplined approach, and maintaining a long-term perspective, investors can enhance their ability to recognize and respond to bear traps, ultimately improving their chances of achieving their investment goals.

cryptocurrency signals provide valuable insights for investors seeking to navigate specific markets. While Asia Signal focuses on market trends and developments in Asian financial markets, cryptocurrency signals help individuals assess price movements and trends in the volatile cryptocurrency market. By understanding and analyzing these signals, investors can make more informed decisions and potentially capitalize on investment opportunities.

In addition to futures signals, utilizing crypto signals can also be advantageous. Joining a Crypto VIP signal service provides access to expert analysis and insights into the cryptocurrency market.

Comments